The Reality of Fire Damage and Your Financial Obligations

What happens to your mortgage if your house burns down is a question thousands of homeowners face each year. The harsh reality is that your mortgage debt remains even when your home is destroyed.

Your mortgage obligation continues because the loan is a separate legal contract from the property. You still owe the full balance to your lender.

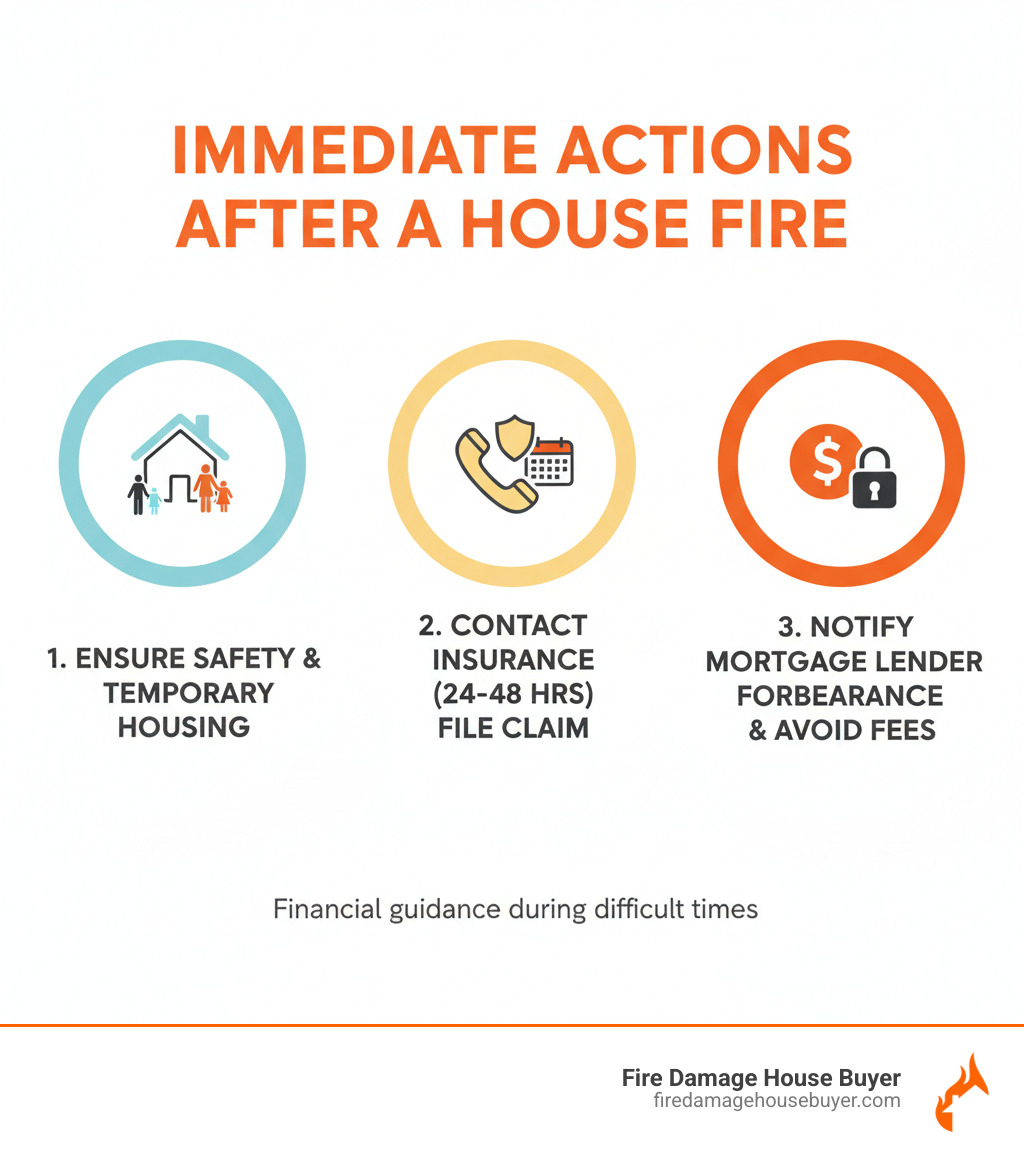

Key immediate steps:

- Contact your mortgage servicer to request disaster forbearance.

- File an insurance claim, as it’s your primary financial lifeline.

- Understand your options: rebuild, pay off the loan, or sell the property.

Rebuilding a fire-damaged home typically costs $34,000 more than buying an existing home, with total restoration costs often ranging from $150,000 to $500,000.

Your insurance company issues claim payments to both you and your mortgage lender, meaning the lender controls the funds. This process is complex and draining.

I’m Daniel Cabrera. At Fire Damage House Buyer, I’ve helped many homeowners steer the financial challenges after a fire. I know how overwhelming the insurance and lender negotiations can be for families dealing with trauma.

Your First Steps and Immediate Financial Obligations

After a fire, with your family safe, practical questions arise. The most pressing is: What happens to your mortgage if your house burns down? Your mortgage doesn’t disappear with your house; your financial obligations remain.

Do you still have to pay your mortgage if your house is destroyed?

Yes, you still have to pay your mortgage even if your house is completely destroyed. This shocks many homeowners, but your mortgage is a separate legal contract from your physical house. The house is collateral, but the loan obligation continues even if the collateral is destroyed. Think of it like a car loan; you still owe the money even if the car is totaled. The debt doesn’t disappear just because the building does. While it feels unfair, you are legally responsible for repaying the loan.

For more detailed information about navigating this challenging situation, check out our Fire Damage Resources page.

Contacting Your Lender and Requesting Forbearance

Lender communication is key. After ensuring everyone’s safety, notify your mortgage servicer immediately about the fire. Lenders require this notification, but the call is also about getting help.

Ask about payment relief options like disaster forbearance. This allows you to temporarily suspend payments for 3 to 12 months without penalties or credit damage. Government-backed loans from Fannie Mae and Freddie Mac often require lenders to offer these options. This provides breathing room for immediate needs like temporary housing. Forbearance is not loan forgiveness; you must repay the missed payments later.

Repayment options after forbearance include a lump sum, adding payments to the loan’s end, or loan restructuring. Get all agreements in writing.

Notifying Your Insurance Company

At the same time, you must file a claim immediately with your homeowner’s insurance company. It’s your primary financial lifeline.

Documenting the damage is crucial. Take photos and videos of everything you can safely access. Don’t discard anything until the insurance adjuster has seen it.

Creating an inventory of lost items is difficult but necessary. List everything you can remember with as much detail as possible (brand, model, purchase date, cost). Keep all receipts for temporary living expenses like hotels and meals, as these may be covered under your loss of use coverage.

Our Post-Fire Recovery Checklist can help you stay organized. The insurance claim process can take months, adding stress while you’re grieving.

What Happens to Your Mortgage if Your House Burns Down: The Role of Insurance

Understanding what happens to your mortgage if your house burns down means grasping how your homeowner’s insurance is your financial lifeline. It protects both you and your lender’s investment, which is why mortgages require it. Insurance is the bridge between financial disaster and recovery. For detailed guidance, our Fire Damage Insurance Claims Guide walks you through every step.

How Insurance Payouts Work with a Mortgage

Insurance payouts can be frustrating. Your mortgage lender is listed as a “loss payee” on your policy, making them a co-payee on any settlement check. This is standard practice to protect the lender’s interest, ensuring the money is used to restore the property.

For significant damage, your lender will deposit the insurance funds into an escrow account and control their release. This ensures the money is used for rebuilding, making the lender an unwanted partner in the process.

Understanding Your Coverage: Dwelling, Personal Property, and Loss of Use

Your policy has several key parts. Dwelling coverage covers the physical structure. It comes as either Replacement Cost (to rebuild at today’s prices) or Actual Cash Value (factoring in depreciation). Replacement cost is usually better.

Personal property coverage covers your belongings and is typically 50-70% of your dwelling coverage. A detailed home inventory is invaluable here.

Loss of Use coverage (or Additional Living Expenses/ALE) is immediately helpful, paying for temporary housing and meals that exceed your normal budget. Keep every receipt for documentation.

The Lender’s Role in the Rebuilding Process

If you rebuild, your lender becomes an active participant, controlling the disbursement of insurance funds in stages to ensure their collateral is restored. Lenders typically use a multi-stage payment schedule tied to construction progress, requiring inspections before each release. They may also hold back 10% until final completion.

This process adds time and stress. Rebuilding costs range from $150,000 to $500,000 and can be $34,000 more than buying an existing home. Managing contractors and inspections can feel like a full-time job. Some lenders may require loan modifications or refinancing, adding to the financial strain. For more information, see our guide on Fire Damage Restoration Near Me.

Many homeowners find it simpler to Sell Fire Damaged House as-is, avoiding the rebuilding process entirely.

The Big Decision: Rebuild, Pay Off the Loan, or Sell?

After the immediate crisis, you face a huge decision about your family’s future. You have three main paths, and the choice is deeply personal. Our guide on whether to Rebuild or Sell After House Fire can help you weigh your options.

Option 1: Rebuilding Your Home

Rebuilding is often the first instinct. However, it is expensive, complicated, and emotionally draining. Your lender controls the insurance funds, releasing them in stages after inspections, which can cause delays. Financially, rebuilding often costs $34,000 more than buying an existing house. Hidden damage can lead to cost overruns, potentially requiring a construction loan to cover shortfalls. Finding qualified fire restoration contractors is another hurdle, and the process can take 8-12 months or more.

Option 2: Paying Off the Mortgage and Walking Away

A simpler option is using insurance money to pay off your mortgage. If the payout is sufficient, you’ll own the land free and clear, without monthly payments or lender oversight. This gives you the freedom to sell the land or hold it as an investment. The challenge is that if the payout only covers the loan, you may not have funds for a down payment on a new home.

Option 3: Selling the Property As-Is

An increasingly popular option is selling the fire-damaged property as-is. This avoids the headaches of rebuilding, contractors, and lender inspections. When you Sell Fire Damaged House to a cash buyer, you bypass these complications. The process is straightforward: a cash buyer makes an as-is offer and can close quickly, often in two weeks. This provides immediate cash and flexibility to find a new home on your own timeline. Selling as-is provides immediate closure, allowing you to focus on moving forward instead of managing a year-long construction project. Understanding How to Price a Fire Damaged House can help you make an informed decision.

Navigating Complications and Worst-Case Scenarios

Not every fire situation goes smoothly. Understanding potential complications can help you prepare for what happens to your mortgage if your house burns down when things go wrong.

What happens to your mortgage if your house burns down when you’re underinsured?

Being underinsured is a common, heartbreaking situation where your dwelling coverage won’t cover the full cost of rebuilding. For example, if you owe $200,000 on your mortgage but only have $150,000 in coverage, you’re responsible for the $50,000 gap after the insurance payout. This gap creates a financial nightmare. You may have to pay the difference out of pocket, sell the land to cover the debt, or face foreclosure. The emotional and financial pressure is enormous. A HUD-approved housing counselor can help you explore options and advocate with your lender.

What happens to your mortgage if your house burns down and you have no insurance?

This is the worst-case scenario. The brutal reality is your full mortgage balance remains due. With no insurance payout, you’re left with the entire debt and no home. Your lender will likely start foreclosure proceedings to recover what they can from the land’s value. This destroys your credit, and you may still owe money after the sale.

Government assistance from FEMA can help with immediate needs but won’t pay off your mortgage or fund a rebuild. While you can explore Post-Fire Recovery Resources, your options are extremely limited without insurance. Mortgage contracts require insurance, and if your policy lapses, lenders may purchase expensive “lender-placed insurance” that protects them but offers you minimal coverage, adding the high cost to your mortgage payment.

These scenarios show why adequate insurance is essential. If you’re in this situation, selling your property as-is can help you recover some value and move on.

How to Prepare in Advance for a House Fire

Nobody wants to think about a house fire, but preparation can save you from financial disaster. Understanding what happens to your mortgage if your house burns down beforehand lets you handle a crisis with confidence.

Review Your Homeowner’s Insurance Annually

Review your insurance policy annually. It’s a financial lifeline that needs regular attention.

- Ensure adequate dwelling coverage. Building costs rise, so coverage that was adequate years ago may now be insufficient. Ask your agent to help you calculate current replacement costs.

- Understand replacement cost vs. ACV. Replacement cost pays to rebuild with new materials at today’s prices. ACV factors in depreciation. The payout difference can be massive.

- Check for exclusions. Standard policies don’t cover everything, like floods or earthquakes. Know what gaps exist in your coverage.

- Confirm loss of use limits. This Additional Living Expense (ALE) coverage pays for temporary living costs. Ensure your policy’s limits are sufficient for several months.

As insurance expert Todd Curry advises, understanding your coverage is invaluable. A higher premium for better coverage is worth it if you ever need to file a claim.

Create a Detailed Home Inventory

Creating a home inventory now is valuable because remembering every lost item after a fire is nearly impossible.

- Video walkthroughs are an easy method. Use your smartphone to record every room, describing items, brands, and model numbers.

- Photo documentation is good for valuable items like jewelry and electronics. Capture serial numbers.

- Digital spreadsheets provide the most detail. List items with descriptions, serial numbers, purchase dates, and values.

- Store everything off-site. An inventory is useless if it burns with your house. Use cloud storage (Google Drive, Dropbox) or keep a copy with a trusted friend.

Keep Important Documents Secure

After a fire, you’ll need important documents to prove your identity and ownership. Having them accessible simplifies recovery.

- Create digital copies of critical documents like mortgage statements, insurance policies, IDs, and birth certificates.

- Use secure cloud storage like Google Drive or Dropbox to keep digital copies accessible from anywhere.

- Invest in a fireproof safe for irreplaceable original documents like birth certificates and passports.

This preparation is easier now than trying to reconstruct your life from ashes later, allowing you to focus on your family’s recovery.

Conclusion

A house fire is a devastating experience that creates emotional trauma and financial uncertainty. The harsh answer to what happens to your mortgage if your house burns down is that your obligation continues. The debt doesn’t disappear.

Your homeowner’s insurance is your lifeline, but the claims process is a difficult, full-time job when you’re already drained. You have three main paths: rebuilding your home, using insurance money to pay off your mortgage, or selling the damaged property as-is.

Rebuilding seems natural but is a harsh reality. The process can take 12-18 months, with costs from $150,000 to $500,000 or more often exceeding insurance coverage. Managing contractors and lender oversight adds stress, and total costs can be $34,000 higher than buying an existing home.

For many families, the simplest path forward is to Sell Fire Damaged House as-is. This approach eliminates the stress of reconstruction and lengthy negotiations.

At Fire Damage House Buyer, we understand your situation. We specialize in purchasing fire-damaged properties nationwide, offering a fast, all-cash solution so you can move forward. Our process is simple: no repairs, no commissions, and no lengthy negotiations. We handle the complexities so you can focus on your family’s recovery.

You have options. The best choice is often the one that helps you move forward fastest. Get a no-obligation cash offer today and see how we can help you start fresh.