The Hidden Opportunity in Fire-Damaged Real Estate

Fire damaged homes for sale represent a unique niche in the real estate market, attracting both bargain-hunting buyers and homeowners seeking a quick exit from a difficult situation. Here’s what you need to know:

Quick Overview of Fire Damaged Homes for Sale:

- For Buyers: These properties typically sell 10-50% below market value, offering potential investment opportunities for experienced renovators or investors willing to tackle extensive repairs.

- For Sellers: You can sell as-is to cash buyers, avoiding the burden of repairs, or invest in restoration before listing traditionally.

- Average Restoration Costs: $3,107 to $51,243, with a national average of $27,175 for total fire and smoke damage repair.

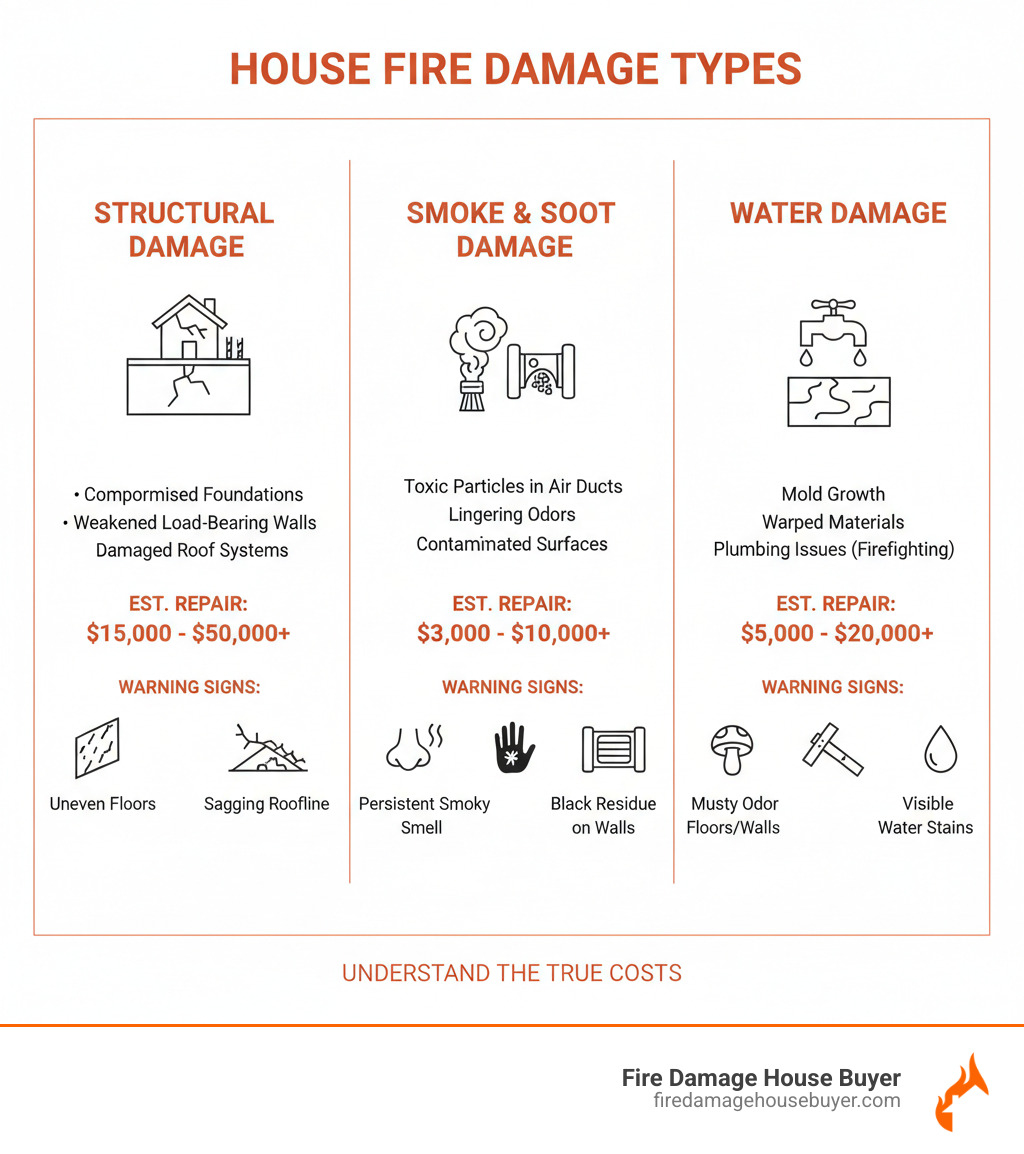

- Common Damage Types: Structural damage, smoke and soot contamination, and water damage from firefighting efforts.

- Where to Find Them: MLS listings, local fire departments, insurance agents, real estate investors, and specialized platforms.

For buyers, these properties offer cost savings and less competition. For sellers, they present a complex challenge: weighing the financial burden of repairs against the uncertainty of a sale.

But fire damage goes far beyond what you can see. Smoke particles penetrate walls and ventilation systems. Water from firefighting efforts breeds mold behind drywall. Structural damage may lurk in foundations and load-bearing walls. Even after spending tens of thousands on restoration, buyers remain hesitant due to the property’s history.

The market for fire-damaged houses has grown as investors recognize the potential for significant returns. An average of 354,000 house fires occur each year in the US, creating a steady stream of these properties. Some buyers successfully transform scorched structures into valuable assets, while others find themselves trapped in money pits with hidden costs that spiral out of control.

I’m Daniel Cabrera. With 15 years as a real estate investor, I’ve bought and sold over 275 houses, specializing in fire damaged homes for sale and helping homeowners steer this challenge. Whether you’re considering buying a fire-damaged property or need to sell one quickly, understanding the true costs and realistic timelines is essential before making any decisions.

The Allure of the Fixer-Upper: Why Consider a Fire-Damaged Home?

For the savvy investor or the ambitious homeowner, fire damaged homes for sale can be a diamond in the rough, offering unique opportunities that are often overlooked by the average buyer. The market for these properties has gained considerable traction, primarily because they come with significantly reduced prices. This lower entry point allows us to find accessible entry points into sought-after neighborhoods that would otherwise be out of reach.

One of the most compelling advantages is the potential for significant returns. Many fire-damaged homes are worthy investments if they’re located in a good neighborhood with competitive comparable sales. This means we can often purchase a property well below market value, invest in necessary renovations, and sell it for a premium. The money saved on the initial purchase can then be channeled into high-quality renovations, leading to a truly customized and valuable asset.

Another key benefit is the reduced competition. The prospect of extensive repairs often deters traditional homebuyers, creating a less competitive marketplace. This gives us more negotiation room and a better chance to secure properties that might otherwise be snatched up quickly in a hot market. Whether you’re looking for a fix-and-flip project or a long-term buy-and-hold rental, fire damaged homes for sale offer a distinctive real estate niche where savvy buyers can transform disaster into opportunity. These properties are often sold “as-is,” further streamlining the acquisition process for those ready to tackle the renovation journey.

Before You Buy: Understanding the True Cost of Fire Damage

For first-time buyers of fire damaged homes for sale, the bargain price tag is just the beginning. Buyers get excited about a property at 40% below market value, but the real work often reveals a different story.

The damage you can see is rarely the whole story. Fire compromises a structure in ways not obvious to the untrained eye.

Structural damage is the most serious concern. Fire can weaken foundations, warp load-bearing walls, and compromise roof systems. Even minimal-looking fire damage can hide compromised support beams. A professional structural and electrical inspection is essential to ensure the building is safe.

Now consider the costs you probably didn’t factor into your renovation budget. Repairing fire and smoke damage typically runs between $3,107 and $51,243, with the national average around $27,175. Minor repairs might only cost $3,000 to $5,000. However, major repairs can easily blow past $50,000. Larger fires—especially those that destroy a kitchen or cause significant roof damage—can run $15,000 to $25,000 per room. For a detailed breakdown, check our guide on the Cost to Repair Fire Damaged House.

Water damage from firefighting efforts creates another major problem. Firefighters use thousands of gallons of water, which seeps into walls and flooring, creating a breeding ground for mold. If not addressed within 24 to 48 hours, you’ll face a costly mold remediation project. Electrical systems get compromised by both fire and water, often requiring complete rewiring. Plumbing suffers from melted pipes and water infiltration. These hidden costs add up fast.

Smoke and soot aren’t just cosmetic problems—they’re serious health hazards. Smoke is composed of toxic fine particles that penetrate deep into furniture, walls, and air ducts, causing respiratory issues and other health problems. The EPA warns about the health hazards of smoke and soot, emphasizing the significant risks. Painting over smoke damage isn’t enough. Proper cleanup requires special equipment to eliminate odors that deter future buyers.

The permit maze is another common hurdle. Renovating a fire-damaged property means navigating complex building codes and obtaining numerous permits for structural, electrical, plumbing, and other work. Adhering to these regulations is required to ensure your project is safe and legal.

The bottom line? Buying a fire-damaged home demands a realistic assessment, a clear understanding of costs, and a substantial contingency fund—typically 20-30% above your initial estimate—to address surprises. It’s not a project for someone with limited renovation experience or tight finances. For many homeowners, the simpler path is selling as-is to a cash buyer rather than taking on this massive undertaking.

A Homeowner’s Guide: Evaluating Fire Damaged Homes for Sale

Finding fire damaged homes for sale requires a proactive approach, as they often exist in a shadow market. The most straightforward starting point is conducting targeted MLS searches for keywords like “as-is,” “needs TLC,” or “fire damage.” However, many of the best deals are off-market.

Proactive sourcing is key. Connect with local firefighters and insurance agents, set up Google Alerts for local house fires, or drive through neighborhoods to spot unlisted damaged properties. Networking with real estate professionals specializing in distressed properties can also uncover off-market deals.

Due diligence is non-negotiable. Hire professional inspectors with specific experience in fire-damaged homes. Specialists can identify hidden nightmares like compromised structures, smoke penetration, and mold that general inspectors might miss. These inspections cost money but can save you from a financial disaster.

Evaluating ROI requires determining if a property is a sound investment or a money pit. Create a detailed repair budget and add a substantial contingency fund—we recommend 10-20% of your estimated repair costs—for surprises. Research regional labor and material costs, as they can dramatically impact your bottom line.

Next, conduct a market analysis to compare the property’s current value, post-renovation value, and local comps. This reveals your potential ROI and helps you determine if the numbers make sense. For a comprehensive look at what restoration entails, check out our Fire Damage Restoration Guide.

The Buying Process for Fire Damaged Homes for Sale

The buying process for fire damaged homes for sale has unique challenges.

Negotiating the purchase price is easier with professional inspection reports. Use these findings to justify your offer based on estimated repair costs.

Financing is a major hurdle. Traditional lenders often avoid financing fire-damaged properties due to high risk. Most buyers of fire-damaged properties use cash purchases, which makes the deal more attractive to sellers and allows for quicker closings.

Without cash, you’ll need specialized financing. The FHA 203(k) loan finances both the purchase and renovation costs, but it comes with strict requirements and a complex approval process. Rehabilitation loans are another option. Private or hard money lenders are more flexible but come with higher interest rates and shorter terms that reduce profit margins.

Legal and insurance considerations add complexity. Conduct a title search for liens or disputes and work with a real estate attorney experienced in distressed properties to protect yourself. Insurance can be tricky, as standard policies may have exclusions. You’ll need to research specialized providers and provide detailed documentation of the property’s condition and your renovation plans. For a deeper understanding, see our guide on Legal Financial Considerations After Fire.

The Restoration Journey: What to Expect

Restoring a fire-damaged home is a long, often frustrating journey.

Hiring the right contractors is crucial. Look for certified professionals with specific experience in fire damage restoration, like those with Institute of Inspection, Cleaning, and Restoration Certification (IICRC) credentials. They have the specialized knowledge for smoke removal, soot cleanup, and structural repairs. Always check reviews, get references, and obtain multiple quotes.

The restoration timeline depends on the severity of the damage. Minor repairs might take a few weeks, but extensive renovations can span three to six months. Severe cases can take 12 to 18 months to rebuild. Factor these timelines into your financial projections.

Building codes and permits are mandatory. Local codes vary and influence renovation costs. You’ll need permits for major work like structural, electrical, and plumbing repairs. Skipping this step can cause serious legal and financial problems when you sell. For practical guidance, explore our article on Cleaning Up After a House Fire.

For Homeowners: The Simpler Way to Handle a Fire-Damaged Property

For homeowners, dealing with a fire-damaged house is often an incredibly stressful and emotional experience. The psychological and emotional toll extends far beyond the physical damage. The thought of selling such a property might seem impossible, especially when faced with the financial burden of repairs and the uncertainty of a traditional sale.

Many homeowners find themselves in a difficult position:

- Emotional Toll: The trauma of a house fire can make it hard to even step foot back into the property, let alone manage extensive repairs.

- Financial Burden: Repairing fire and smoke damage can be incredibly expensive, with costs ranging from $3,107 to $51,243, averaging around $27,175. For major damage, this can easily exceed $50,000. These costs often drain savings or require homeowners to take on more debt.

- Uncertainty of a Traditional Sale: Even after costly repairs, buyers can be hesitant due to the property’s history, fearing hidden damages or future recurrence. This means a longer time on the market, more price reductions, and the need for meticulous documentation of all repairs to build buyer confidence.

This is where a cash buyer alternative truly shines. We understand that not every homeowner has the time, resources, or emotional capacity to undertake a lengthy and costly restoration. Our company specializes in buying fire-damaged houses in any condition, offering a straightforward solution that bypasses the traditional selling problems. You can learn more about your options in our Can You Sell a Fire Damaged House? Quick Guide.

The “As-Is” Advantage for Fire Damaged Homes for Sale

When we purchase fire damaged homes for sale, we buy them “as-is” for cash. This approach offers significant advantages for homeowners:

- No Repairs Needed: You don’t have to spend a single dime or lift a finger on costly, time-consuming repairs. We take on the property in its current condition, regardless of the extent of the fire damage.

- No Commissions or Fees: Unlike traditional real estate agents, we don’t charge commissions, saving you thousands of dollars (typically 5-6% of the sale price). We even cover closing costs!

- Fast Closing: We can close very quickly, often within seven days or less, providing you with immediate cash. This is a significant relief compared to the months it can take to sell a damaged home traditionally.

- Certainty of Sale: With a cash offer, there’s no waiting for buyer financing to fall through or dealing with endless contingencies. You get a guaranteed sale.

- Simplified Disclosure: While transparency is always important, selling to a cash buyer who specializes in distressed properties means they are fully aware of and accept the fire damage, simplifying the disclosure process for you. This reduces your liability and potential headaches down the line.

- Quick Cash Offer: We can provide a fair, no-obligation cash offer, often within 24 hours of assessing the property. This allows you to quickly move forward and put the incident behind you.

Opting to sell your fire-damaged house “as-is” to us means avoiding the stress, financial drain, and uncertainty associated with restoration and traditional sales. It’s a simpler, faster way to get cash for your property and move on with your life. If you’re ready to explore this option, you can Sell Fire Damaged House directly to us.

Frequently Asked Questions about Fire-Damaged Homes

Here are answers to common questions about fire damaged homes for sale.

Is it a good idea to buy a house that had a fire?

Buying a fire-damaged home can be profitable, but it’s not for everyone. It’s a high-risk venture best suited for experienced buyers with significant capital for repairs.

A thorough professional inspection is crucial to uncover hidden structural, smoke, and water damage. Restoration costs often exceed initial estimates. A professional assessment is essential to understand the full scope of damage and restoration costs.

For homeowners, the real question is whether they should invest in repairs at all.

Can you get a mortgage on a fire-damaged property?

Getting a traditional mortgage on a fire-damaged property is extremely difficult. These homes rarely meet the safety and habitability standards required by lenders.

Most buyers use cash, which is why investors dominate this market. If you don’t have cash, you might explore specialized renovation loans like the FHA 203(k) loan. However, these loans have stringent criteria, extensive oversight, and longer closing times.

Private or hard money loans are another alternative, but they have higher interest rates and shorter terms that can reduce profit margins.

For sellers, this financing challenge is a major obstacle. Selling to a cash buyer who specializes in fire damaged homes for sale eliminates this uncertainty, as there are no financing contingencies.

How much value does a house lose after a fire?

A house’s value typically decreases by at least 10% to 50% or more after a fire. The value loss depends on the extent of structural damage and the property’s location. The land itself retains value.

Even after extensive repairs, a property’s history can lead to buyer apprehension, resulting in lower offers and more time on the market. Worries about hidden damage or lingering odors create a psychological barrier.

The substantial cost ($3,107 to $51,243+) and time involved in restoration often don’t make financial sense for homeowners dealing with the emotional toll of a fire. Selling as-is to a company like ours is often the smarter choice, allowing you to get cash quickly and avoid the restoration headache. To learn more, visit Sell Fire Damaged House.

Conclusion: A Diamond in the Rough or a Money Pit?

So here we are at the crossroads. Fire damaged homes for sale can go either way—they’re either a brilliant opportunity or a financial nightmare waiting to happen. For the experienced investor with deep pockets and a solid team of contractors, these properties can transform into impressive profit generators. Buy low, renovate smart, sell high. It’s a formula that works beautifully when everything goes according to plan.

But here’s the reality check: things rarely go exactly according to plan with fire-damaged properties. That “simple” kitchen fire that seems contained? It might have compromised electrical systems throughout the house. Those cosmetic smoke stains? They could be hiding toxic particles deep in your walls and ventilation. The water damage from firefighting efforts? It’s probably breeding mold in places you can’t even see yet. Before you know it, your $27,000 repair estimate has ballooned to $60,000, and you’re still months away from completion.

For homeowners dealing with fire-damaged properties, the situation is even more challenging. You’re not just facing a financial burden—you’re carrying an emotional weight that’s hard to describe to anyone who hasn’t been through it. The thought of coordinating contractors, navigating permits, fighting with insurance companies, and then trying to convince buyers that your restored home is worth full market value? It’s exhausting just thinking about it. And that’s before we mention the 12 to 18 months it typically takes to rebuild a severely damaged house from the ground up.

This is exactly why we created our company. We’ve seen too many homeowners trapped in this nightmare, watching their savings drain away while their damaged property sits vacant, accumulating more problems by the day. We believe there’s a better path forward—one that doesn’t require you to become an expert in fire restoration, building codes, and contractor management overnight.

When you choose to Sell Fire Damaged House to us, you’re choosing simplicity over stress. You’re choosing certainty over uncertainty. You’re choosing to move forward with your life rather than being anchored to a property that reminds you of one of your worst days. We handle the headaches, the hidden costs, and the months of restoration work. You get cash in hand and the freedom to start fresh.

Whether you’re an investor calculating your next move or a homeowner just trying to find solid ground again, understanding what you’re truly facing with fire damaged homes for sale is essential. For investors, make sure your numbers include that crucial contingency fund and that your timeline accounts for the inevitable surprises. For homeowners, know that you have options—and the simplest one might be the best one.

Ready to explore a straightforward solution? We’re here to help. Contact us today for a free, no-obligation cash offer. Let’s turn your fire-damaged property from a burden into closed chapter, quickly and without the stress of traditional restoration and sale.