What Is a Fire Claims Adjuster and Why Does Your Recovery Depend on Them?

After a devastating house fire, a fire claims adjuster becomes a pivotal figure in your recovery. This professional investigates the damage, evaluates your insurance claim, and determines the payout from your insurance company. Understanding their role and who they work for can mean the difference between a fair settlement and financial hardship.

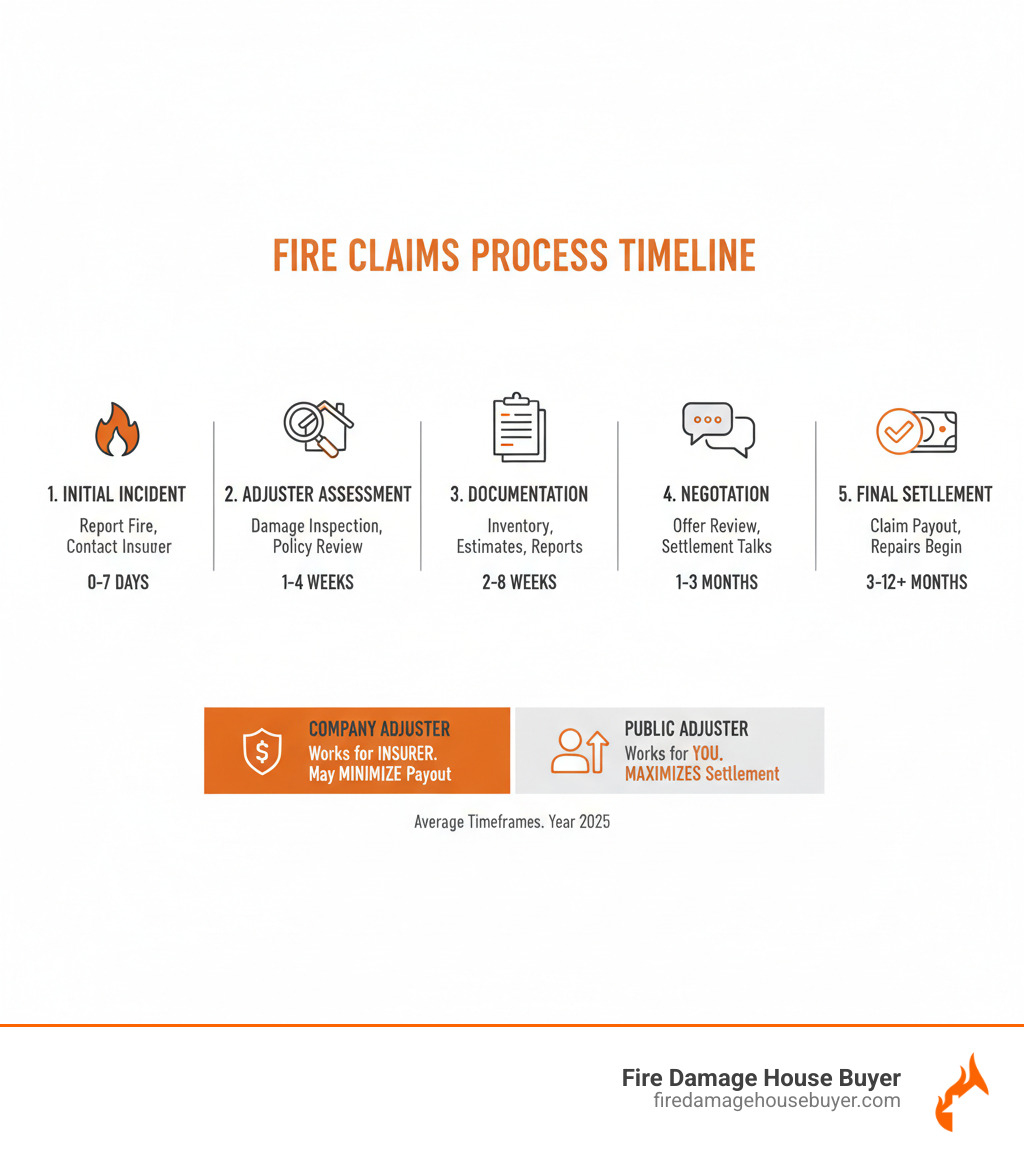

Types of Fire Claims Adjusters:

- Company/Staff Adjuster – Works directly for your insurance company.

- Independent Adjuster – Contracted by the insurance company, but not their employee.

- Public Adjuster – Works exclusively for you, the policyholder, to maximize your settlement.

Key Responsibilities:

- Inspecting fire damage to your property and belongings.

- Documenting losses and reviewing your insurance policy.

- Calculating repair costs and replacement values.

- Negotiating settlement amounts.

Critical to Know: Company and independent adjusters work for the insurance company, not for you. Their goal is to minimize the insurer’s payout, which may not align with your need for full compensation.

The fire insurance claim process is notoriously complex, and for a stressed, displaced family, it can feel impossible. Many homeowners are shocked to find their insurer’s initial settlement offer is significantly lower than what they need to recover. Fire damage restoration costs can range from $3,000 to over $100,000, not including temporary housing or replacing personal belongings.

I’m Daniel Cabrera, a fire-damaged property specialist. For 15 years, I’ve seen how the claims process can drain families emotionally and financially. My company offers a simpler alternative for those who want to move forward quickly without the stress of dealing with fire claims adjusters and complex settlements.

Understanding the Key Players in a Fire Claim

After a fire, you’ll deal with various professionals, but not all of them are on your side. The most important is the fire claims adjuster, but there are different types, and knowing who they work for is critical to your financial outcome.

The Company Adjuster (or staff adjuster) is an employee of your insurance company. Their job is to investigate your claim while protecting their employer’s bottom line. It’s not personal; it’s business.

Independent Adjusters are third-party contractors hired by the insurance company, often during busy periods like wildfire season. While not direct employees, they are still paid by the insurer and work to protect the insurance company’s interests.

The Public Adjuster is the only type of fire claims adjuster who works exclusively for you, the homeowner. They act as your advocate, assessing damage, documenting losses, interpreting your policy, and negotiating with the insurance company to maximize your settlement. Public adjusters are licensed professionals who typically charge a percentage of your final settlement, so they are motivated to get you the best possible outcome. Hiring one for a complex claim can significantly increase your final payout. For more on this, see our guide on Public Adjuster for Fire Damage.

Here’s the fundamental difference:

| Feature | Company Adjuster | Public Adjuster |

|---|---|---|

| Who They Work For | The Insurance Company | The Policyholder (You!) |

| Primary Goal | Cost-effective settlement for the insurer | Maximum fair settlement for the policyholder |

| How They Are Paid | Salary from the insurance company | Percentage of the final settlement |

The conflict of interest is clear. The person your insurer sends to evaluate your claim has an incentive to minimize costs. This doesn’t mean they are dishonest, but their definition of a “fair” settlement might be far from what you need to rebuild. They might value items at a depreciated cash value, miss hidden smoke damage, or underestimate restoration costs.

Whether you handle the claim yourself, hire a public adjuster, or skip the headache by selling your fire-damaged house as-is, knowing who is on your team makes all the difference.

The Complex Journey of a Fire Insurance Claim

The fire insurance claims process is exhausting, often turning into months of paperwork and waiting while you’re dealing with the trauma of losing your home. The journey unfolds in four phases, each with its own challenges. The entire process can stretch for many months, which is why our Fire Damage Insurance Claims Guide can be a helpful resource.

Phase 1: Immediate Steps After a Fire

The first 48 hours are critical. Here’s what to do:

- Prioritize Safety: Do not re-enter your home until cleared by fire officials.

- Notify Your Insurer: Report the fire immediately to start the claims process and get a fire claims adjuster assigned.

- Secure the Property: Board up windows and cover roof holes to prevent further damage. Keep all receipts for these emergency repairs.

- Arrange Temporary Housing: If your home is uninhabitable, use your Additional Living Expenses (ALE) coverage for hotels and meals. Document every expense.

- Mitigate Further Damage: Your policy requires you to take reasonable steps to prevent more damage, like water extraction or removing salvageable items. Save all receipts for reimbursement.

For a complete checklist, see our guide on What to Do After a House Fire.

Phase 2: Damage Assessment and Documentation

This phase is tedious but crucial. The fire claims adjuster will do their own assessment, but you must not rely on them alone. For a neutral standard of what adjusters should document after a major loss, review the California Department of Insurance’s Guide for Adjusting Property Claims in California After a Major Disaster (useful even if you don’t live in California).

- Document Everything: Take extensive photos and videos of all damage, from wide shots to close-ups.

- Create a Home Inventory: List every single damaged or destroyed item with its description, brand, age, original cost, and replacement cost. This is exhausting but necessary to get what you deserve.

- Distinguish Damage Types: The adjuster will separate structural damage (building) from content damage (belongings). Both need thorough documentation.

- Identify Hidden Damage: Fire damage isn’t just what you see. Smoke can infiltrate HVAC systems and walls, and water from firefighting can cause mold. Point these out if the adjuster overlooks them.

Phase 3: Negotiation and Settlement with the fire claims adjuster

Once everything is documented, negotiation begins. Know your policy, especially these two terms:

- Replacement Cost Value (RCV): The cost to replace property with new items of similar quality.

- Actual Cash Value (ACV): The replacement cost minus depreciation for age and wear.

The difference can be thousands of dollars. For example, the ACV for a 10-year-old roof might be low, but the RCV covers the full, inflated cost of a new one today.

Initial offers are almost always negotiable. Use your detailed inventory and contractor quotes to counter a lowball offer. Disputes often arise over the extent of damage or the value of belongings. Don’t accept the first offer without getting independent estimates. Our guide on Legal & Financial Considerations After Fire can help you understand your rights.

Phase 4: The Long Road of Repairs and Rebuilding

If you decide to rebuild, you’re in for a marathon that can take six months to a year or longer.

- Get Contractor Bids: Obtain detailed written estimates from several reputable contractors.

- Manage the Restoration: This becomes a full-time job of coordinating with contractors, inspectors, and your insurance company.

- Expect Unexpected Costs: Delays, code upgrades, and material shortages are common and can push you over budget.

Restoration costs for moderate damage typically run $26,000 to $47,000, while severe structural damage can exceed $100,000. After months of this, many homeowners ask: Is rebuilding worth it? The emotional toll and financial uncertainty lead many to explore other options, like selling as-is. Our guide on Rebuild or Sell After House Fire can help you weigh the pros and cons.

A Simpler Path: Sell Your Fire-Damaged House As-Is

After learning about the exhausting process of working with a fire claims adjuster and managing reconstruction, you might be wondering if there’s another way. The answer is yes. You can choose a path that lets you move forward immediately.

Selling your fire-damaged house as-is for cash means you can skip the entire insurance claims battle. You don’t need to wait for a fire claims adjuster to approve every item or argue over depreciation. Instead, you receive a fair cash offer and close quickly, putting money in your pocket to start fresh.

Here’s what makes this option so appealing:

- No Repairs or Cleaning: We buy houses in any condition, saving you tens of thousands of dollars and countless hours. We handle all the debris and cleanup after closing.

- Avoid Hassle and Delays: You bypass months of contractor negotiations, permit issues, and construction delays. Those problems won’t be yours to manage.

- Fast Closing: While insurance claims drag on for months, we can close in just days or weeks. This speed provides the cash you need to secure new housing and move on with your life.

- Certainty and Peace of Mind: You get a no-obligation cash offer upfront. You know exactly what you’re getting, which provides immense emotional relief and allows you to plan your future.

We work with homeowners across the country, making the process simple for families who’ve already been through enough. Our How to Sell a Fire Damaged House: Quick Guide explains the steps.

We assess your property’s condition, location, and market value to make a Fair Cash Offer House. There’s no obligation to accept. Many homeowners who initially plan to rebuild change their minds after experiencing the reality of the claims process. Choosing to Sell Fire Damaged House is a practical decision that prioritizes your family’s well-being over a stressful and uncertain restoration.

Frequently Asked Questions About Fire Claims

Navigating fire damage recovery brings up many questions about fire claims adjusters and the insurance process. Here are answers to the most common concerns.

When should I hire a public fire claims adjuster?

You can hire a public adjuster at any time, but they are most valuable in specific situations:

- Large or Total Loss Claims: For extensive or catastrophic damage, a public adjuster can identify all losses, including hidden smoke and water damage, ensuring nothing is overlooked.

- Complex Policy Language: Insurance policies are filled with jargon. A public adjuster can interpret your policy to identify all applicable coverages and counter an insurer’s attempts to deny parts of your claim.

- Disagreements with the Offer: If your insurance company’s offer feels too low, a public adjuster can effectively negotiate on your behalf using detailed documentation and industry knowledge.

- Lack of Time or Expertise: Managing a fire claim is a full-time job. A public adjuster can take this burden off your shoulders, handling all communication and negotiation while you focus on your family.

How are personal belongings valued in a fire claim?

Insurance companies use specific methods to value your belongings, which can be a harsh reality for homeowners.

- Actual Cash Value (ACV): This is the most common initial valuation. It’s the item’s replacement cost minus depreciation for age and wear. A five-year-old TV you paid $1,200 for might be valued at only $300.

- Replacement Cost Value (RCV): If your policy includes it, this covers the cost to replace items with new ones of similar quality. However, you typically receive the ACV first and get the remaining amount (recoverable depreciation) only after you buy the replacement and provide receipts.

This is why a detailed inventory list with descriptions, purchase dates, costs, and photos is critical. Proof of ownership (receipts, credit card statements, photos) strengthens your position. Sentimental value is not compensated; policies focus strictly on monetary value.

What if my insurance claim is denied or underpaid?

A denied or underpaid claim is not the final word. You have options to fight back.

- Review the Denial Letter: Insurers must provide a written explanation citing specific policy language. Understand their reasoning to build your response.

- Gather Additional Evidence: Collect contractor reports, photos, and other documents that contradict the insurer’s decision.

- Use the Internal Appeals Process: Submit a formal written appeal to the insurance company with all your supporting evidence. Document every conversation and keep copies of all correspondence.

- Seek Outside Help: If appeals fail, consider hiring a public adjuster or using a mediator. A neutral third party can help facilitate a resolution. Legal action is a final resort.

Even a successful appeal is an exhausting process. This is why many families decide that selling their fire-damaged house as-is is the simpler, saner path to recovery.

Conclusion: Your Two Paths Forward After a House Fire

After a house fire, you’re at a crossroads. The path you choose will define your financial and emotional recovery for months to come.

The traditional path involves a long battle with a fire claims adjuster, managing a stressful reconstruction, and navigating the complex insurance process. Restoration costs for moderate damage often range from $26,000 to $47,000, and can exceed $100,000 for severe damage, not including the months of displacement and emotional exhaustion.

The alternative path is simple: sell your fire-damaged house as-is for cash and move forward immediately. No cleaning, no negotiating with adjusters, and no waiting on contractors. Just a fair cash offer, a quick closing, and the freedom to start your next chapter.

This isn’t giving up; it’s choosing to rebuild your life somewhere new, without the constant reminder of trauma. Fire Damage House Buyer helps families across all 50 states make this transition. We provide fair, no-obligation cash offers for properties in any condition, handling the cleanup and repairs so you don’t have to. You can close in days, not months, putting cash in your hand when you need it most.

Your house is damaged, but your future doesn’t have to be. Request a free no-obligation cash offer today and learn more about our simple process.