Understanding Your Options After a House Fire

How to sell a burned house can feel like an impossible question in the days and weeks after a devastating fire. But the truth is, you have clear options and a straightforward path forward. Here’s what you need to know:

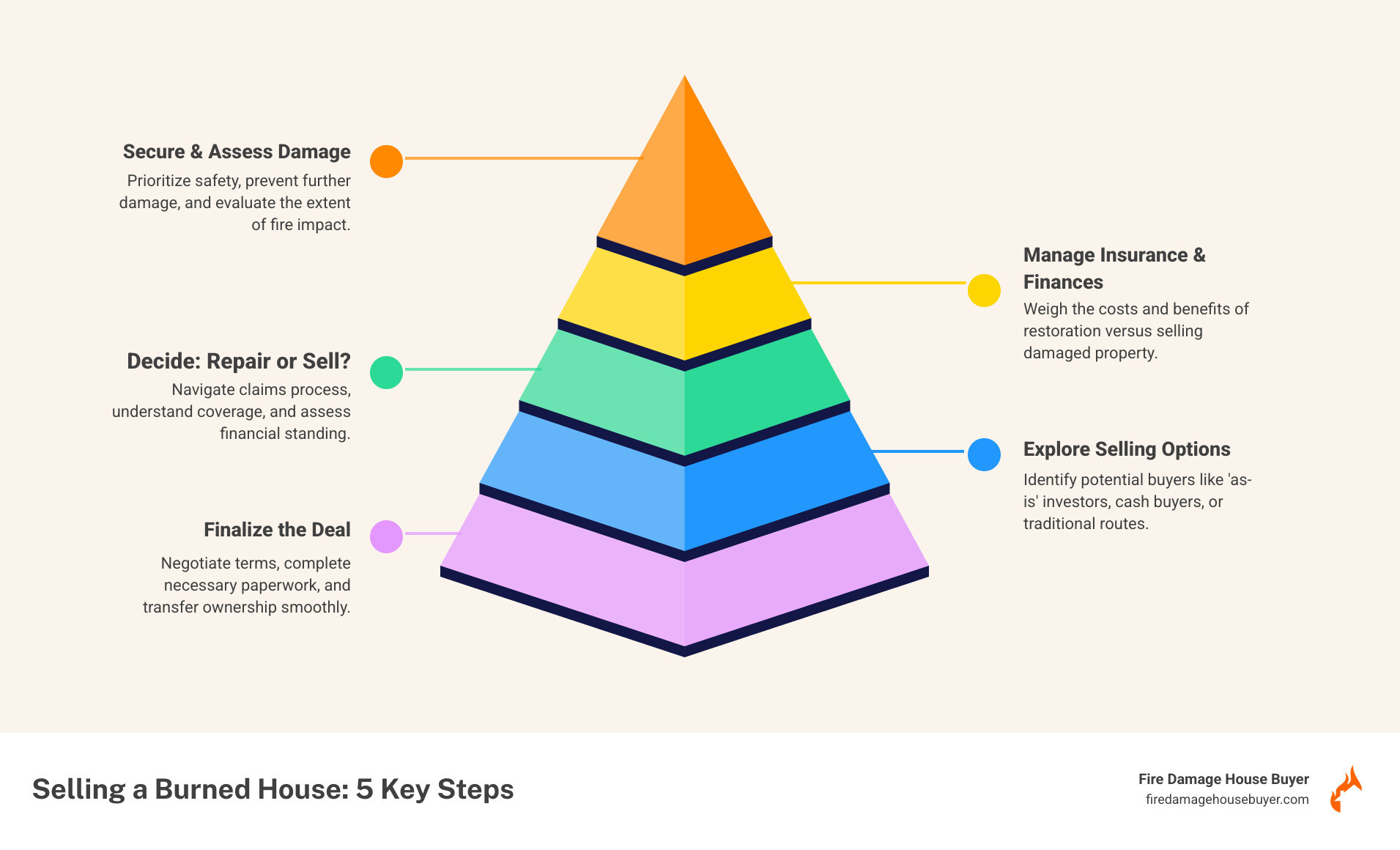

Quick Answer: The 5 Essential Steps

- Secure the property – Wait for fire department clearance, shut off utilities, and document all damage

- Steer your insurance claim – Contact your insurer immediately and understand your policy coverage

- Decide: repair or sell as-is – Compare restoration costs ($27,175 average, up to $50,000+) against selling directly for cash

- Choose your selling method – Traditional listing vs. direct cash sale (7-10 day closing)

- Complete the transaction – Gather documents, disclose damage, and close the deal

A house fire transforms your life in an instant. Beyond the immediate trauma and safety concerns, you’re suddenly facing overwhelming questions about insurance claims, temporary housing, and what to do with a damaged property. According to industry data, repairing fire and smoke damage typically costs between $3,107 and $51,243, with the national average sitting around $27,175 for total repairs. Larger fires affecting kitchens or causing significant roof damage can cost $15,000 to $25,000 per room to repair.

The financial burden is just one part of the equation. Many homeowners find that traditional real estate channels close their doors to fire-damaged properties, leaving them feeling trapped and uncertain. You’re dealing with insurance adjusters calculating losses, contractors estimating repairs, and the constant stress of coordinating a complex restoration process that can take 6 to 12 months or longer.

But here’s what most homeowners don’t realize: you don’t have to repair your house to sell it. There’s a simpler path that bypasses the entire restoration nightmare, avoids months of stress, and puts cash in your hands within days, not months.

This guide will walk you through the five essential steps to steer selling your fire-damaged home, whether you choose the lengthy restoration route or the faster as-is option. We’ll cover everything from securing the property and managing insurance claims to understanding your selling options and closing the deal with confidence.

I’m Daniel Cabrera, founder of Fire Damage House Buyer, and over the past 15 years I’ve personally bought over 275 distressed properties, including many fire-damaged homes, helping homeowners understand exactly how to sell a burned house quickly and fairly. My goal is to give you the information you need to make the best decision for your family’s future.

You may also want to read those following articles:

Step 1: Secure the Property and Assess the Damage

When your home has been affected by fire, the very first priority is safety. Before you even think about how to sell a burned house, you must ensure the property is safe to enter and secure from further damage or unauthorized access.

Do not re-enter your home until the fire department has given you official clearance. They will determine if the structure is stable and if any hazards, such as gas leaks or live electrical wires, are present. Once cleared, immediately contact your utility companies (gas, electricity, water) to ensure all services are safely shut off. This prevents further accidents and can mitigate ongoing damage.

Next, it’s crucial to secure the property. This means boarding up broken windows and doors, and potentially fencing off the area, especially if the damage is extensive. This protects your property from theft, vandalism, and the elements, which can worsen existing damage.

After securing the property, arrange for a professional damage assessment. This isn’t just about what you can see; fire damage can be sneaky. We recommend hiring a qualified home inspector, fire restoration specialist, or structural engineer. These professionals can identify hidden issues that an untrained eye might miss. For a comprehensive guide on immediate post-fire actions, refer to our article on What to Do After a House Fire.

Finally, obtain the official fire marshal report. This document is vital for insurance claims and any future sale. Document all damage carefully with photographs and videos from multiple angles. This visual evidence will be invaluable for your insurance claim and for potential buyers.

Types of Fire Damage to Identify

Fire damage is rarely just about the burnt areas. It often involves a complex interplay of different types of destruction:

- Structural Damage: Fire can compromise the integrity of walls, roofs, floors, and foundations. Heat can weaken steel beams, char wooden supports, and crack concrete. A structural inspection is essential to determine if the house is salvageable.

- Soot and Smoke Damage: Smoke and soot can penetrate every corner of your home, far beyond where the flames reached. They can contaminate HVAC systems, embed into porous materials like drywall and fabrics, and leave behind corrosive residues and persistent odors.

- Water Damage from Firefighting: The efforts to extinguish the fire often lead to significant water damage. This can cause mold growth, rot, and further structural weakening, especially if not dried out quickly.

- Electrical System Hazards: Electrical fires are common, and even if the fire started elsewhere, the heat can melt wiring, damage circuit breakers, and create unseen electrical hazards throughout the house.

- HVAC Contamination: If your heating, ventilation, and air conditioning system was running during the fire, smoke and soot particles could have spread throughout your ductwork, requiring extensive cleaning or replacement.

- Foundation Issues: Extreme heat can cause concrete foundations to crack or spall. Water saturation can also exacerbate existing foundation problems.

Understanding these different types of damage is key to assessing the true condition of your property. For more detailed information on home fires and safety, consult the Ready.gov Home Fires Guide.

Step 2: Steer Your Insurance Claim and Finances

After a fire, navigating insurance claims and managing your finances can feel like a maze. Yet, this step is absolutely critical, whether you plan to repair or how to sell a burned house as-is.

Your first call, after ensuring safety, should be to your homeowner’s insurance provider. Inform them about the fire and initiate the claims process. They will assign an insurance adjuster whose role is to assess the damages for the insurance company’s claim process. We strongly recommend hiring your own independent home inspector or public adjuster. An independent professional provides an unbiased assessment of the property’s condition, including structural, mechanical, and electrical systems, which can be invaluable when negotiating with your insurer.

Crucially, understand your policy: do you have Actual Cash Value (ACV) or Replacement Cost coverage?

- Replacement Value is the cost to rebuild or replace your home as it was before the fire, without deducting for depreciation.

- Actual Cash Value (ACV) is the replacement cost minus depreciation. This means you might receive less than the full cost of repairs, potentially leaving you to cover the difference.

Your insurance policy should cover fire damage, including dwelling, personal property, liability, and potentially loss of use (temporary housing). For a deeper dive into what your policy covers, check out our guide: Does House Insurance Cover Fire Damage?.

Keep meticulous records of all communication with your insurance company, including names, dates, times, and summaries of conversations. Document every expense related to the fire, from temporary housing to debris removal.

If you have a mortgage, your lender will also be involved. Insurance checks for repairs on mortgaged properties are often made out to both the homeowner and the lender. This means you’ll typically need your lender’s endorsement to access the funds for repairs. Understanding your mortgage obligations after a fire is paramount. Read more on this topic in our article: What Happens to Your Mortgage if Your House Burns Down?.

Finally, be aware of potential tax implications. If insurance proceeds exceed your adjusted basis, involuntary conversion rules might apply, potentially allowing tax deferral if you reinvest in similar property. You may also qualify for casualty loss deductions for uninsured losses, though recent tax law changes have limited this. Always consult with a tax professional or CPA for personalized advice.

Step 3: Make the Critical Decision: Repair or Sell As-Is?

This is the most important decision you’ll make. One path involves a long, expensive, and stressful restoration process, while the other offers a quick, simple, and certain exit. Making the right choice hinges on your financial situation, emotional capacity, and desired timeline.

1b infographic ” src=”https://images.bannerbear.com/direct/4mGpW3zwpg0ZK0AxQw/requests/000/121/406/147/NWlVkgmbMQExwgbD6ZyAqEwDo/985e2457f18817620bd93278c98f041094e2cd12.jpg”/>

| Criteria | Repair Before Selling | Sell As-Is to Fire Damage House Buyer |

|---|---|---|

| Timeline | Long: 6-12+ months (often longer for severe damage) | Fast: 7-10 days to close, sometimes quicker |

| Costs | High: $3,107 – $51,243 (Avg. $27,175); plus 20% for unexpected | Low: No repair costs, no commissions, no closing costs |

| Effort/Stress | High: Managing contractors, permits, inspections, emotional drain | Low: No repairs, no cleaning, no showings, simple paperwork |

| Buyer Pool | Traditional buyers (can get mortgages) | Cash buyers (investors, developers) |

| Sale Price | Potentially higher (if repairs are perfect) | Fair cash offer (reflecting damage and repair costs) |

| Financing | Buyers use traditional loans (can be difficult for damaged homes) | Cash payment, no lender involvement |

| Guaranteed Sale? | No, subject to buyer financing, inspections, appraisals | Yes, once offer is accepted |

| Emotional Impact | Prolonged exposure to memories of the fire | Quicker emotional detachment and fresh start |

The Long, Costly Path of Restoration

If you decide to restore your home before selling, be prepared for a significant undertaking. The restoration process is complex and involves multiple stages, from initial cleanup and debris removal to structural repairs, smoke remediation, and rebuilding. Our House Fire Damage Restoration Guide offers detailed insights into this process.

The costs of restoration can be substantial. As mentioned, repairing fire and smoke damage can cost between $3,107 and $51,243, with a national average of $27,175 for total repairs. For larger fires that destroy a kitchen or cause significant roof damage, costs can escalate to $15,000 to $25,000 per room. Severe damage often requires $75,000 or more for full rehabilitation. Remember to factor in an additional 20% to cover unexpected issues and building code updates, as these are common surprises. For more detailed cost breakdowns, you can consult the Angi Fire Damage Restoration Cost Guide.

Beyond the financial outlay, the timelines are extensive. Restoration projects can take several months, and it’s not unusual for severe fire damage restoration to take over 6 months, or even 12 months or longer. This means months of managing contractors, securing permits, dealing with inspectors, and overseeing the entire rebuilding process. The emotional drain of living with the constant reminder of the fire and the stress of managing a major construction project can be overwhelming. Before committing to this path, consider the pros and cons outlined in our article: Rebuild or Sell After House Fire.

The Simple, Fast Path: How to Sell a Burned House As-Is

For many homeowners, the thought of extensive repairs after a fire is simply too much. This is where selling “as-is” becomes an attractive option. Selling as-is means you sell your property in its current condition, with all existing damages, without undertaking any repairs or cleanup.

The benefits of this approach are clear:

- No Repairs or Cleanup Needed: You don’t have to spend a dime or lift a finger on renovation or cleaning. We handle everything, from debris removal to full restoration.

- Avoiding Financial Risk and Unforeseen Costs: You sidestep the uncertainty of repair costs, which often run over budget, and the additional 20% buffer needed for unexpected issues.

- Speed and Certainty: This is perhaps the biggest advantage. While traditional sales can drag on for months, a cash sale to a specialized buyer can close in as little as 7-10 days. You get immediate financial relief and can move on quickly.

- Simplified Selling Process: No real estate agents, no commissions (typically 5-6%), no showings, no negotiations over repairs, and no buyer financing falling through.

At Fire Damage House Buyer, we specialize in buying fire-damaged homes for cash across all the states we operate in, including Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, DC, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming, and many more. We offer a streamlined, hassle-free process that allows you to close this difficult chapter and start fresh. To learn more about this option, read our article on the Pros and Cons of Selling a House As-Is and understand Selling Fire Damaged House: What to Expect.

Step 4: Explore Your Selling Options

Once you’ve secured your property, steered your insurance, and decided whether to repair or sell as-is, the next step in how to sell a burned house is to explore your selling options. It’s crucial to understand the market realities for fire-damaged properties, as they differ significantly from selling a pristine home.

Option 1: Selling on the Traditional Market

If you choose to repair your home fully, you can then list it on the traditional real estate market with a real estate agent. This is often the path homeowners hope for, as a fully restored home can command a higher price. However, even with repairs, you might face some challenges:

- Limited Buyer Pool for Damaged Homes: Even after repairs, some buyers are hesitant to purchase a home with a history of fire damage. The average consumer is often overwhelmed by the thought of rehabbing a fire-damaged property, and this can shrink the buyer pool.

- Buyer Financing Often Fails: Lenders are often hesitant to provide mortgages for fire-damaged homes, even if repaired. Buyers using FHA, VA, or conventional loans may struggle to secure financing, especially if the repairs are not deemed 100% complete.

- Requires Significant Upfront Repairs: To attract traditional buyers and secure financing, you’ll need to invest heavily in repairs. These costs can be substantial (average $27,175, potentially over $50,000 for severe damage).

- Agent Commissions (5-6%): When you sell through a traditional agent, you’ll pay significant commissions, typically 5-6% of the sale price, which further reduces your net profit.

- Long, Uncertain Timeline: Even with repairs, selling on the traditional market can take months. The process involves showings, open houses, negotiations, appraisals, and inspections, all of which can be lengthy and stressful.

- Intense Buyer Scrutiny and Inspections: Buyers will likely request multiple specialized inspections to ensure all damage has been properly addressed. Any lingering concerns can lead to renegotiations or even a canceled sale.

Option 2: Selling Directly to Fire Damage House Buyer for Cash

For homeowners who want to avoid the complexities, costs, and uncertainties of the traditional market, selling directly to a cash buyer like Fire Damage House Buyer is an excellent alternative.

Who are cash buyers? We are real estate investors and specialists in distressed properties, including those with fire damage. Our business model involves buying properties as-is, handling all repairs and renovations ourselves. This allows us to provide a quick, hassle-free solution for sellers. Read our article Cash Offer Better for Seller? for more details.

The benefits of choosing Fire Damage House Buyer are compelling:

- Fast Closing (7-10 Days): We can typically complete a transaction within 7-10 days from your initial contact to closing. This is significantly faster than any other selling method, providing immediate relief.

- No Commissions or Hidden Fees: When you sell to us, there are no real estate agent commissions, and we cover all standard closing costs. The offer you receive is the cash you get.

- No Repairs or Cleaning: We buy your property exactly as it is, regardless of the extent of fire damage. You don’t need to lift a finger for repairs, cleanup, or even moving unwanted personal items.

- Guaranteed Sale: Once we make an offer and you accept, the sale is guaranteed. There are no financing contingencies, no lengthy inspections to worry about, and no last-minute buyer pull-outs.

- Transparent Offer Process: We determine our offer based on the property’s after-repair value (ARV). Our formula is: ARV – Cost of Repairs – Holding Costs – Our Profit Margin = Your Cash Offer.

- Operating in Your State: We have locations and buy properties in all the states listed above, ensuring we can help you, no matter where your fire-damaged home is located.

We simplify the entire process, allowing you to move forward without the emotional and financial burden of a fire-damaged property. Learn more about our straightforward process on our How It Works page.

Step 5: How to Sell a Burned House and Finalize the Deal

Regardless of whether you choose to repair and sell traditionally or sell as-is to a cash buyer, the final step in how to sell a burned house involves preparing for a smooth sale and confidently closing the deal. This stage focuses on documentation, legal protection, and the actual transfer of ownership.

Preparing for a Smooth Sale

A well-prepared seller is a protected seller. Gathering and organizing essential documents is paramount:

- Fire Report: The official report from the fire marshal or fire department detailing the incident, cause, and extent of damage.

- Insurance Paperwork: All documentation related to your insurance claim, including your policy, claim forms, adjuster’s reports, and settlement details.

- Repair Estimates/Invoices: If you undertook any repairs, keep all estimates, contracts, and paid invoices. This demonstrates the quality of work and compliance with codes.

- Property Deed and Title Documentation: Proof of ownership and a clear title are fundamental for any real estate transaction.

- Property Tax Records and Mortgage Information: Recent tax statements and your mortgage payoff information will be needed by the title company.

- Government-Issued ID: For identity verification during closing.

Legal Disclosure Requirements: Every state has laws regarding property disclosures. You are legally obligated to disclose all known defects, especially those related to fire damage. This includes the cause of the fire, the date it occurred, any insurance claims made, and the nature of repairs completed (or not completed). Transparency is not just good practice; it’s your best defense against future legal issues. For a comprehensive overview, review our guide on Legal and Financial Considerations After a Fire.

Working with a real estate attorney can provide invaluable legal protection, ensuring your contracts are sound and you meet all disclosure obligations.

Closing the Deal with Confidence

The closing process is the final step where ownership is transferred, and funds are exchanged.

- Review the Purchase Agreement: Carefully read and understand the purchase agreement. If you’re selling to a cash buyer like Fire Damage House Buyer, our agreements are straightforward. If using a traditional agent, ensure your attorney reviews it.

- Understand Liability Transfer: Ensure the purchase agreement clearly outlines when liability for the property transfers to the buyer. This is especially important for properties sold as-is.

- The Role of a Title Company: A title company (or escrow agent) acts as a neutral third party to facilitate the transaction. They will conduct a title search to ensure there are no liens or claims against the property, manage the transfer of funds, and ensure your mortgage is paid off from the sale proceeds.

- The Closing Timeline: For cash sales to Fire Damage House Buyer, the closing timeline is remarkably fast, often 7-10 days. Traditional sales, especially after repairs, can take 30-60 days or more.

- Receiving Your Cash Payment: At closing, after all necessary deductions (like mortgage payoff, if applicable), you will receive your cash payment, usually via wire transfer or certified check.

- Post-Sale Responsibilities: After closing, remember to transfer or disconnect all utilities, notify your insurance company of the sale, and inform your local tax assessor’s office and municipality.

By carefully preparing your documents and understanding the closing process, you can finalize the sale of your fire-damaged home with confidence, allowing you to move forward.

Frequently Asked Questions about Selling a Burned House

Can I sell my house if the insurance claim is still pending?

Yes, you can sell with an active claim. You have flexible options: you can either transfer the claim rights to the buyer or keep them. Fire Damage House Buyer is experienced in handling this and can structure the deal to protect your interests, ensuring you don’t have to wait for the insurance company to move forward. We often work with properties that have ongoing insurance claims, and we can help steer the complexities of claim assignment or resolution as part of the sale process.

How does Fire Damage House Buyer determine their offer for a fire-damaged home?

We calculate our offer based on the property’s after-repair value (ARV). We use a transparent formula: ARV – Cost of Repairs – Holding Costs – Our Profit Margin = Your Cash Offer. This comprehensive process accounts for various factors including the property’s location and neighborhood characteristics, current real estate market conditions, the extent and type of fire damage, estimated restoration costs, and the potential market value after repairs are completed. Each offer reflects a thorough assessment to provide you with a fair, no-obligation offer.

Do I need to clean out the property or remove debris before selling as-is?

No. When you sell to Fire Damage House Buyer, you sell the property completely “as-is.” This means you can walk away without cleaning, clearing debris, or even removing personal belongings you don’t want. We take full responsibility for the entire property and its contents, including all cleanup and restoration efforts. Our goal is to provide you with a hassle-free selling experience during an already difficult time.

Conclusion: Your Easiest Path Forward After a Fire

Dealing with a house fire is devastating, and the path to recovery can seem daunting. As we’ve outlined, you can steer this challenge in five clear steps, from the initial assessment to the final sale. While restoring your home is an option, it’s a journey filled with high costs (averaging $27,175, often exceeding $50,000 for severe damage), long delays (6-12+ months), and immense stress.

The simplest, most effective solution is often to Sell Fire Damaged House as-is for cash. This allows you to bypass the entire restoration nightmare, avoid commissions, and close in as little as a week. At Fire Damage House Buyer, we specialize in providing homeowners like you with a fair cash offer, allowing you to close this difficult chapter and start fresh. If you’re ready for a stress-free solution, contact us today for your no-obligation cash offer.