What You Need to Know About Fire Insurance Payouts

Facing the aftermath of a house fire is devastating. Understanding the average insurance payout for house fire claims can help you plan your next steps and avoid financial surprises during an already stressful time.

Quick Answer: Average Fire Insurance Payouts

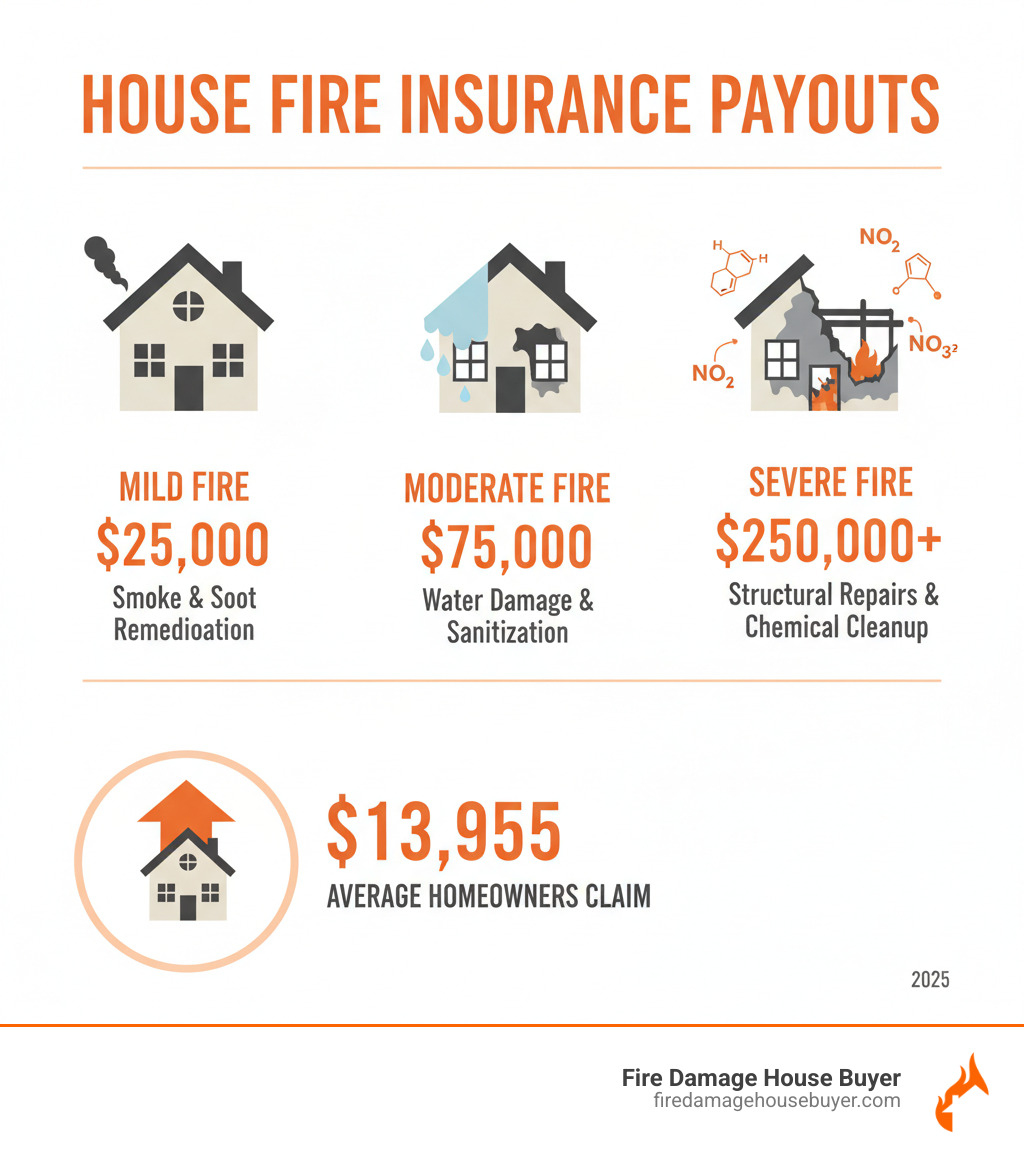

- National Average (2017-2021): $83,519 per claim

- Typical Range: $50,000 to $350,000, depending on damage severity

- Mild Fire (smoke/soot only): ~$25,000

- Moderate Fire (water damage, multiple rooms): ~$75,000

- Severe Fire (structural damage, total loss): $250,000+

- Cleanup Costs: $5-$10 per square foot

The actual amount you receive depends on your policy, coverage limits, and the extent of the damage. Fire and lightning claims are among the most expensive homeowners insurance claims, averaging significantly more than claims for theft or water damage.

I’m Daniel Cabrera. With 15 years of experience helping homeowners steer fire damage insurance settlements and distressed property sales, I’ve seen how the average insurance payout for house fire claims can vary and how restoration often costs more and takes longer than expected.

Understanding the Average Insurance Payout for a House Fire

After a house fire, the biggest question is: “How much will my insurance pay?” While every situation is unique, data provides a realistic picture of what to expect.

What is the Average Insurance Payout for a House Fire?

According to the Insurance Information Institute, the average insurance payout for house fire and lightning claims from 2017 to 2021 was $83,519. This substantial amount reflects just how destructive these events can be.

For perspective, the average homeowners claim for other issues was just $13,955 in 2020. Fire claims are in a different league, often six times more expensive. However, the actual payout range is incredibly wide. A partial loss claim might settle for around $50,000, while a total loss—where rebuilding costs exceed your policy limits—can easily reach $350,000 or more. This massive range is why understanding your specific situation is so important.

If you’re wondering how we help homeowners move forward in these situations, you can learn more about our company and our mission to provide straightforward solutions.

How Damage Severity Influences the Claim Amount

The severity of the fire will dramatically impact your final payout. Think of it as a scale from manageable to devastating.

Mild fire damage means the fire was contained, but smoke and soot can infiltrate your entire home. These situations usually involve professional smoke and soot remediation, deep cleaning, and replacing contaminated belongings, with an average cost of around $25,000.

Moderate fire damage is more complicated. This level means the fire spread to multiple rooms, and firefighting efforts caused substantial water damage. You’re looking at sanitization, removal of burnt materials, and extensive restoration work, with an average payout around $75,000.

Severe fire damage is the nightmare scenario. Large sections of your home are destroyed, structural elements are compromised, or you’re facing a complete rebuild. These claims regularly exceed $250,000. The heat from severe fires explains how hot does a house fire get and why the damage is so catastrophic.

Beyond direct damage, professional cleanup typically runs between $5 and $10 per square foot. For a 2,000 square foot home, that’s an extra $10,000 to $20,000 before any repairs even begin. These numbers are averages, and your actual payout depends on many factors, raising the question: is the lengthy insurance and restoration process the best path for you?

Key Factors That Determine Your Final Payout

Your final insurance payout isn’t a simple calculation; it’s determined by several factors outlined in your homeowners policy. Understanding these is crucial for managing expectations and receiving a fair settlement.

Policy Type: Replacement Cost (RCV) vs. Actual Cash Value (ACV)

Your policy’s payout method—Replacement Cost Value (RCV) or Actual Cash Value (ACV)—is a critical factor.

- Replacement Cost Value (RCV): This is the more favorable option, paying to replace your property with new items of similar quality, without deducting for depreciation.

- Actual Cash Value (ACV): This coverage pays to replace your property minus depreciation, which accounts for age and wear and tear. You’ll get significantly less than the cost of a new item.

Here’s a quick comparison:

| Item | Original Cost | Age (Years) | Depreciation | ACV Payout (Estimate) | RCV Payout |

|---|---|---|---|---|---|

| Roof | $20,000 | 10 | 50% ($10,000) | $10,000 | $20,000 |

| Television | $1,000 | 5 | 70% ($700) | $300 | $1,000 |

| Kitchen Cabinets | $15,000 | 15 | 75% ($11,250) | $3,750 | $15,000 |

The difference is substantial. Many RCV policies first pay the ACV, then release the remaining funds once you’ve replaced the items and provided receipts. For more details, see these resources on Understanding replacement expenses.

Your Coverage Limits, Underinsurance, and the ‘Average Clause’

Your policy has coverage limits—the maximum payout for:

- Dwelling Coverage: The structure of your home.

- Personal Property Coverage: Your belongings.

- Additional Living Expenses (ALE): Costs if you can’t live in your home.

Underinsurance is a major risk. It occurs when your coverage limit is too low to cover today’s rebuilding costs. The ‘average clause’ (or coinsurance clause) can worsen this by penalizing you for not insuring your property to a certain percentage (e.g., 80%) of its value. If you’re underinsured, the insurer will only pay a proportional amount of your loss, leaving you with a large out-of-pocket expense.

What’s Covered vs. What’s Excluded

Most standard policies (like an HO-3) cover fire damage, but exclusions apply.

-

Covered Damage:

- Direct damage from flames, smoke, and soot.

- Water damage from firefighting efforts.

- Damage from accidental fires (e.g., electrical, cooking).

- Lightning and wildfire damage (though policies in high-risk areas may have special conditions).

-

Excluded Damage:

- Arson by the homeowner: This is insurance fraud and will result in a denied claim.

- Vacant Property: If your home is vacant for an extended period (often 30-60 days), coverage may be reduced or excluded.

- Lack of Maintenance: If the fire resulted from neglected issues like faulty wiring, the claim may be denied. See more on wear and tear.

- Nuclear Hazards, War, or Government Action: These are standard catastrophic event exclusions.

Navigating the Fire Insurance Claim Process Step-by-Step

After the fire is out, the work of navigating the insurance claim begins. Following the right steps can significantly impact your average insurance payout for house fire claim.

Immediate Steps to Take After a Fire

After a fire, these critical actions can ensure a smoother claims process:

- Ensure Safety: Your safety is paramount. Do not re-enter the building until authorities declare it safe.

- Contact Emergency Services: Ensure any necessary police or fire reports are filed.

- Notify Your Insurance Company: Contact your insurer’s 24/7 claims hotline as soon as possible.

- Secure the Property: Prevent further damage by boarding up windows or tarping the roof. Keep receipts for any emergency repairs.

- Request an ALE Advance: Ask your insurer for an advance on your Additional Living Expenses (ALE) coverage for immediate costs like housing and food.

- Seek Temporary Housing: Use your ALE coverage to find a safe place for your family to stay.

For more guidance, explore our Post Fire Recovery Resources.

How to Document Losses to Maximize Your Claim

Thorough documentation is your best tool for maximizing your claim.

- Detailed Home Inventory: Create a list of every lost or damaged item, including its description, brand, purchase date, and replacement cost. Use any surviving records or photos.

- Photographic and Video Evidence: Take extensive photos and videos of all damaged areas before any cleanup begins.

- Keep All Receipts: Carefully save all receipts for fire-related expenses, from temporary housing to replacement items.

- Don’t Discard Damaged Items: Your adjuster may need to inspect them, so don’t throw anything away until you get approval.

To stay organized, Download our post-fire checklist to ensure you don’t miss any critical steps.

Working with Adjusters and When to Hire Help

The insurance adjuster evaluates the damage for the insurer. Understanding their role is key.

- Role of the Company Adjuster: An insurance adjustor’s job is to inspect your property, review your documents, and recommend a settlement amount. Their primary loyalty is to the insurance company.

- Your Responsibilities: Be cooperative but firm. Provide all requested documentation promptly and walk through the property with the adjuster. Don’t feel pressured to accept their first offer.

- Disputing Low Offers: If you believe an estimate is too low, you have the right to dispute it with additional evidence and independent contractor estimates.

- Hiring Help: For large or complex claims, consider hiring a Public Adjuster to represent your interests or a Fire Damage Attorney for significant disputes or if you suspect bad faith.

We’ve helped many homeowners through this process. Read our Reviews to see how we’ve supported others in similar situations.

The Payout Process and the Reality of Rebuilding

Once assessments are done, you’ll begin to understand your payout structure and timeline. It’s crucial to prepare for the reality that the payout might not cover everything, and rebuilding is a marathon, not a sprint.

Understanding the Payout Structure and Timeline

Your average insurance payout for house fire claim won’t be a single check. It arrives in stages.

Your initial payment covers immediate needs like temporary housing (ALE) and emergency repairs. The final settlement covers major dwelling repairs and the Actual Cash Value (ACV) of your belongings. If you have a Replacement Cost Value (RCV) policy, the recoverable depreciation (the difference between ACV and RCV) is paid after you replace the items and submit receipts. For dwelling repairs, expect loss draft checks made out to both you and your mortgage lender.

The timeline varies. An initial payment may arrive in weeks, but a full settlement can take months, especially if there are disputes. Understanding the typical claim procedure helps set realistic expectations.

The Impact of a Mortgage on Your House Fire Insurance Payout

If you have a mortgage, your lender is a key player in the payout process.

Your lender is named as a payee on dwelling repair checks to protect their investment. They will likely place the funds in an escrow account and release them in stages as work is completed and passes inspection. Essential communication with your lender is not optional—it’s required to prevent frustrating delays.

Is the Payout Enough? The Stress of Restoration

Even with a good payout, many homeowners find rebuilding is more complex and expensive than expected.

- Common Shortfalls: Your deductible, non-covered items, and being underinsured can leave you with significant out-of-pocket costs.

- Code Upgrades: Rebuilding often requires bringing the home up to current building codes (e.g., new electrical systems), which may not be fully covered by your policy.

- Rebuilding Costs vs. Payout: Rising construction and labor costs can create a gap between your settlement and the actual cost to rebuild.

- Time and Stress: Perhaps the biggest burden is the time and stress of managing contractors, overseeing work, and making countless decisions, all while living in temporary housing for months or even over a year. For guidance on the cleanup phase, see our guide on Cleaning Up After a House Fire.

A Simpler Alternative: Selling Your Fire-Damaged House As-Is

The process of rebuilding—insurance negotiations, managing contractors, living in temporary housing—is overwhelming. Often, the average insurance payout for house fire doesn’t cover the full cost, leaving you with out-of-pocket expenses and the emotional toll of a lengthy restoration.

There is a simpler alternative: selling your fire-damaged house as-is to a cash buyer.

Selling as-is lets you move forward immediately. You bypass the entire restoration process—no waiting for settlements, arguing with adjusters, or managing contractors. You avoid commissions and can close in days, not months. This provides immediate financial and emotional relief.

The Real Cost of Rebuilding

Even with insurance, restoration costs often exceed the payout. Severe damage can cost $75,000+, and basic cleanup alone runs $4.50 to $6 per square foot. Add your deductible, required code upgrades, and other hidden expenses, and you could face tens of thousands in out-of-pocket costs.

Why Selling Makes Sense

If you lack the time, energy, or funds for a long restoration, Fire Damage House Buyer can help. We specialize in buying fire-damaged houses in any condition, throughout all 50 states and Washington D.C. Our process is simple: contact us, we assess your property, and we make a fair, no-obligation cash offer. If you accept, we handle all paperwork and can close in as little as 7 days. No repairs, no commissions, no stress.

Many homeowners wonder, “Can You Sell a Fire Damaged House? Quick Guide“—and the answer is yes. In fact, it’s often the smartest financial decision. To understand your options, Learn how to price a fire-damaged house. Choosing to Sell Fire Damaged House to us means choosing peace of mind and prioritizing your family’s well-being.

Frequently Asked Questions about House Fire Insurance Payouts

We know you have questions, and we’re here to provide clear, simple answers.

Can I keep the insurance money and not repair the house?

Yes, if you own the home outright. You can typically use the Actual Cash Value (ACV) portion of the settlement as you wish. However, if you have a mortgage, your lender will likely control the funds to ensure repairs are made. If you choose not to rebuild, you will forfeit the recoverable depreciation portion of an RCV policy.

Will my insurance premiums go up after a fire claim?

Very likely. A major fire claim often leads to higher premiums or even non-renewal of your policy, as the property is now seen as a higher risk.

Is smoke damage covered even if my property isn’t burned?

Yes. Standard homeowners policies cover smoke damage, even if the fire was elsewhere. Smoke is pervasive and requires professional remediation, which is considered a covered peril.

Conclusion: Making the Best Decision for Your Recovery

Recovering from a house fire is difficult. While the average insurance payout for house fire is a useful benchmark, your final settlement depends on your policy, the damage, and the claims process.

You face a choice: the long, stressful path of rebuilding, filled with unexpected costs and delays, or a straightforward exit that lets you move on now. Choosing simplicity over struggle is a valid and often wise decision. While some choose to rebuild, many want to close this painful chapter and start fresh.

If the thought of managing a rebuild is overwhelming, you’re not alone. The cost of rebuilding often exceeds the insurance payout due to deductibles, non-covered items, and unexpected expenses.

Fire Damage House Buyer offers a better way. We give you a fair cash offer for your property as-is. No repairs, no commissions, and no waiting. We close in days, not months, putting cash in your pocket so you can move on. We serve all 50 states, from California to Florida.

Your insurance payout doesn’t cover the emotional toll or lost time. Selling to us lets you take your settlement, add our cash offer, and start your next chapter unburdened.

This is a big decision, and we’re here to provide an option. To see if this path is right for you, Contact Us for a no-obligation cash offer. We provide honest information to help you recover.