Why You Can Sell Your Fire-Damaged Home

Can you sell a fire damaged house? Yes, you absolutely can. Whether your home has minor smoke damage or major structural issues, there are buyers willing to purchase fire-damaged properties.

Quick Answer:

- Yes, fire-damaged houses can be sold – even with significant damage.

- Two main options: Repair first or sell as-is to cash buyers/investors.

- Typical timeline: 7-10 days for cash sales, 30-180 days for traditional sales.

- Expected value: Usually 20-40% less than pre-fire value, depending on damage extent.

- Common buyers: Real estate investors, renovation specialists, and cash buying companies.

The aftermath of a house fire is overwhelming, but the good news is that fire damage doesn’t make your house unsellable—it just changes your selling strategy.

Fire-damaged homes often sell for 30-40% less than undamaged properties, but this varies based on the extent of damage, location, and market conditions. In high-demand areas like New York, properties can retain 60-70% of their pre-damage value due to strong land values.

Your main decision is choosing between two paths: investing in repairs to attract traditional buyers, or selling as-is to investors and cash buyers who specialize in distressed properties. Each option has distinct advantages depending on your timeline, budget, and stress tolerance.

I’m Daniel Cabrera, founder of Fire Damage House Buyer. With over 15 years specializing in distressed properties, I’ve helped more than 275 families steer this exact situation. My experience shows that while every situation is unique, there’s always a path forward.

Immediate Steps After a House Fire

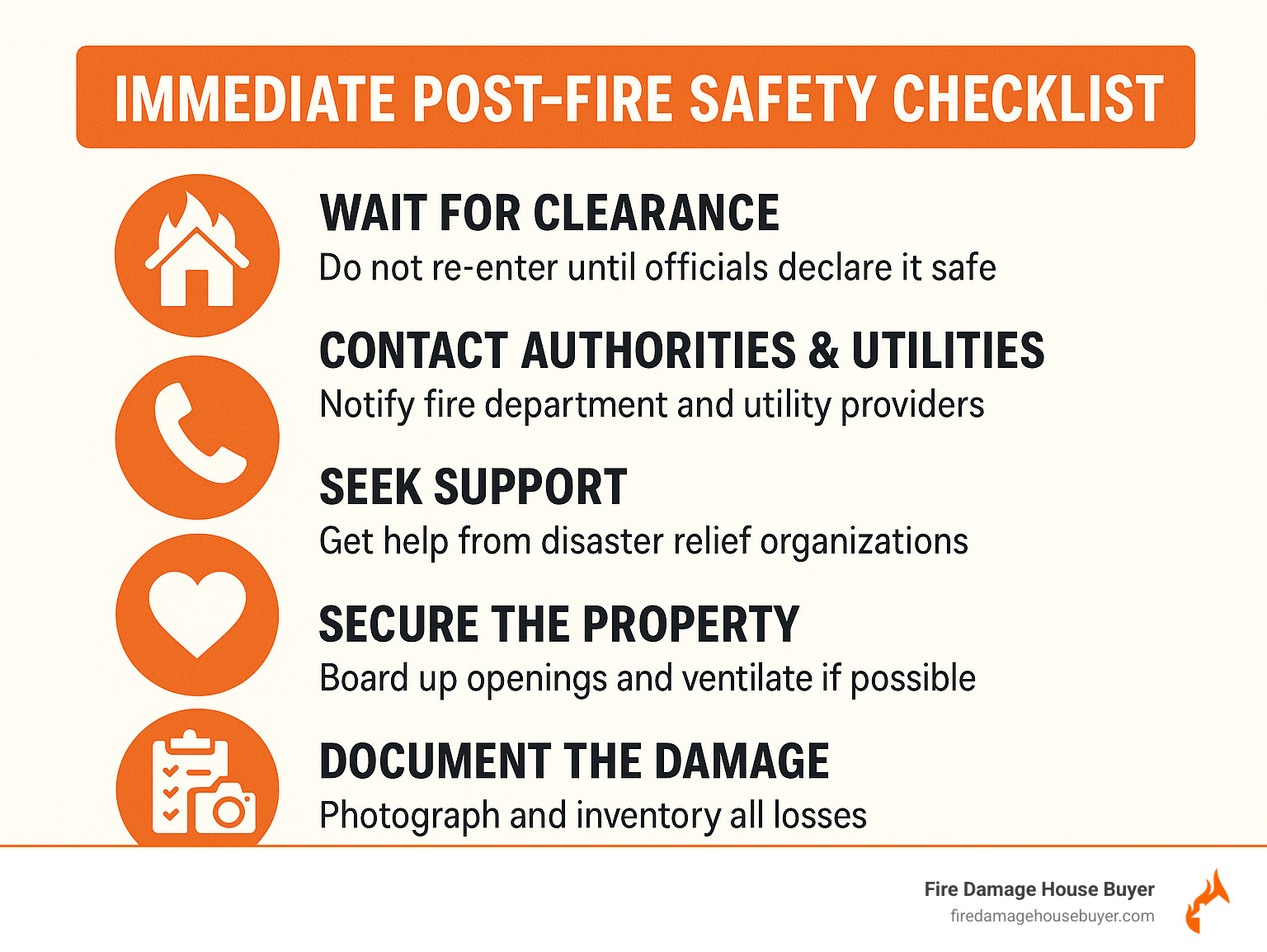

A house fire is an overwhelming experience, but taking these immediate steps can help you regain control.

Your safety comes first. Never enter your fire-damaged home until the fire department officially clears it as safe. A structure can be unstable even if it looks fine, with hidden dangers like toxic fumes and weakened beams.

Once you are safe, contact the authorities. Call your local fire marshal for an official fire report, which you’ll need for insurance claims. Next, contact your utility companies to shut off gas, electricity, and water to prevent further hazards.

You don’t have to face this alone. Organizations like the American Red Cross and local disaster relief services can provide immediate help with temporary housing, meals, and other essentials.

Securing your property is vital. Board up broken windows or damaged doors to protect your belongings. If safe, open undamaged windows to air out smoke odors and empty your refrigerator and freezer if the power is off.

Document everything. Take extensive photos and videos of all damage from multiple angles. This documentation is crucial for your insurance claim and for potential buyers who need to understand the scope of what happened.

How Fire Damage Impacts Your Home’s Value

Understanding how a fire affects your home’s value is crucial for deciding your next steps. While you can’t sell for the original value, your property still has significant worth.

Typically, a fire reduces a home’s market value by 20-40% compared to its pre-fire worth. This figure can change based on several factors, but it’s a realistic starting point. The damage goes beyond what’s visible:

- Structural Integrity: Fire can weaken load-bearing walls, foundations, and the essential frame of your home, making it unsafe even if it appears stable.

- Smoke and Soot Damage: Smoke seeps into every crack and porous surface. The acidic soot it leaves behind corrodes fixtures, stains surfaces, and creates a persistent odor that is difficult to remove.

- Water Damage: Water from firefighting efforts often causes secondary issues like mold growth, wood rot, and further structural problems if not addressed quickly.

- Hidden Destruction: Problems often lurk behind walls, in electrical systems, and within HVAC ducts. A professional assessment is essential to uncover the true extent of the damage.

The financial impact varies by severity. Minor cosmetic issues might reduce value by 10-20%, while severe structural damage can cause a 40-60% drop. The national average for fire damage restoration is around $27,175, but extensive rehabilitation can easily start at $75,000, plus a recommended 20% buffer for unexpected costs.

Location plays a huge role. In high-demand urban areas, properties often retain 60-70% of their pre-damage value because the land itself is so valuable. In less competitive markets, the value reduction is typically more severe. Current market conditions also matter; a seller’s market may attract more investor offers.

Knowing your property’s realistic current value empowers you to make the best decision, whether you repair or sell as-is. For more details on restoration, see our guide on Fire Damage Restoration and Repair.

The Big Decision: Repair Before Selling or Sell As-Is?

This is the biggest decision you’ll face: should you fix the damage or sell the house as it is? There’s no single right answer; it depends on your finances, timeline, and tolerance for stress.

- Repairing before selling involves restoring the home to attract traditional buyers. This path can lead to a higher sale price but requires significant time (often 12-18 months), money, and effort to manage contractors.

- Selling as-is means selling the property in its current condition to a cash buyer or investor. This option is much faster and avoids repair costs and stress, but the sale price will be lower to account for the work the buyer is taking on.

For minor cosmetic damage, repairs might be worthwhile. For major structural issues, selling as-is is often the more practical choice.

Pros and Cons of Repairing the Damage

Repairing your home can lead to a higher sale price and appeal to a wider pool of traditional buyers looking for move-in-ready properties. For minor damage, simple fixes can offer a strong return on investment.

However, the downsides are significant:

- Long Timelines: Expect the process to take 12-18 months from start to finish.

- High Costs: Restoration costs average $27,175 nationally and can easily exceed $50,000 for extensive damage, not including holding costs like mortgage and utilities.

- Stress and Hassle: Managing contractors, dealing with delays, and overseeing a major project is emotionally draining, especially after a fire.

Benefits of Selling a Fire-Damaged House As-Is

Selling your house as-is offers immediate relief and several key advantages:

- Fast Sale: Cash buyers can close in as little as 7-10 days, with no need for bank approvals or lengthy inspections.

- No Repair Costs: You spend $0 on restoration. The buyer handles everything.

- No Commissions: Selling directly to a cash buyer saves you the typical 5-6% real estate agent commission.

- Avoids Stress: You skip the contractor headaches, construction delays, and emotional toll of managing a renovation.

The main trade-off is a lower sale price, as the buyer factors repair costs, risk, and their own profit into the offer. The market is smaller, but the buyers are serious and can act quickly.

| Feature | Selling As-Is | Repairing & Listing |

|---|---|---|

| Timeline | 7-10 days | 30-180 days + 12-18 months repairs |

| Your costs | $0 in repairs, no commissions | $3K-$50K+ repairs, 5-6% commissions |

| Sale price | 40-60% of pre-fire value | 80-90% of pre-fire value |

| Stress level | Minimal | High |

| Buyer type | Cash investors | Traditional homebuyers |

For most families with significant fire damage, selling as-is provides the fastest and simplest path to moving on. When combined with an insurance payout, it can often make you financially whole without the prolonged stress of rebuilding.

Can You Sell a Fire Damaged House? A Step-by-Step Guide

Selling a fire-damaged home successfully follows a clear three-step process. It involves navigating your insurance claim, pricing the property correctly, and meeting all legal requirements.

Step 1: Navigating Your Insurance Claim

Your homeowner’s insurance is a critical asset. Contact your insurer immediately and document every conversation.

It’s vital to understand the difference between Actual Cash Value (ACV) and Replacement Cost Value (RCV). ACV is your property’s value with depreciation, while RCV is the cost to rebuild at today’s prices. Most policies pay ACV first, with the rest of the RCV (the “holdback”) paid after repairs are done.

Crucially, you can typically keep your ACV payment whether you rebuild or sell as-is. This gives you financial flexibility. The RCV holdback, however, usually requires repairs to be completed.

You can sell your home with an open insurance claim. You’ll need to decide whether to retain the insurance proceeds (and sell the house at a lower, as-is price) or assign the policy benefits to the buyer, which can be an attractive option for them but requires careful legal review.

Step 2: How to Price Your Property – Can you sell a fire damaged house for a fair price?

Pricing a fire-damaged home follows a logical formula. To get a fair price, you need to understand what “fair” means for a damaged property.

- Start with the pre-fire market value: What your home was worth in perfect condition.

- Subtract estimated repair costs: Get professional quotes for all restoration work, including smoke and water damage remediation.

- Factor in an investor discount: A cash buyer will apply a discount (typically 10-20%) to the post-repair value to account for their risk, time, and profit. For example, a $300k home needing $75k in repairs might have a starting value of $225k, but an investor offer might be closer to $180k-$200k.

This price reflects the value you receive for avoiding all repair costs, holding expenses, and management stress. Location also heavily influences the final price, with homes in high-demand areas retaining more value.

Step 3: Fulfilling Legal & Disclosure Requirements – Can you sell a fire damaged house without issues?

The legal rule for selling a fire-damaged home is simple: be completely transparent. Full disclosure is your best protection against future legal issues.

- Disclose Everything: Most states require sellers to disclose all known material defects. Fire damage is a major defect. Use the property disclosure statement to detail the fire’s extent, cause, and any repairs made. Do not hide or minimize damage.

- Gather Documentation: Organize all relevant paperwork, including the official fire report, insurance claim documents, photos, and receipts for any cleanup or repairs.

- Record All Repairs: If you made repairs, keep meticulous records, including invoices, permits, and warranties. This builds buyer confidence.

Working with an experienced cash buyer like Fire Damage House Buyer simplifies this process, as we are experts in the legal and disclosure requirements for these unique properties. Honesty protects you and creates a smooth transaction for everyone.

Frequently Asked Questions about Selling a Fire-Damaged Home

Here are answers to the most common questions we hear from homeowners dealing with fire damage.

Who are the typical buyers for fire-damaged houses?

While the buyer pool is smaller than for traditional homes, several groups actively seek these properties. They see an opportunity where others see a problem.

- Real Estate Investors & Flippers: These are experienced professionals with the funds and contractor networks to handle major renovations for profit.

- Cash Buying Companies: Specialists like Fire Damage House Buyer focus exclusively on these properties, offering a fast, simple process designed to help homeowners in your exact situation.

- Developers: In desirable locations, developers may buy severely damaged homes for the land value, planning to tear down the structure and build new.

These buyers are serious and understand the value of your property, even in its damaged state.

How quickly can I sell a fire-damaged house?

The timeline depends entirely on your selling strategy.

- Selling “as-is” to a cash buyer is the fastest option, typically taking just 7-10 days to close. This is because cash buyers don’t need bank financing or lengthy appraisals.

- Repairing first and then listing traditionally is a much slower process. The restoration alone can take 12-18 months, followed by another 30-180 days to find a buyer on the open market.

The speed of a cash sale provides immediate relief from holding costs like mortgage, taxes, and insurance, which can quickly eat into the potential profits of a traditional sale.

Do I need to make repairs before selling my fire-damaged house?

No, you absolutely do not need to make any repairs before selling. Selling “as-is” is a common and often financially prudent choice.

While fixing minor cosmetic damage might offer a good return, undertaking major reconstruction is a different story. For extensive damage, selling as-is allows you to avoid:

- High upfront repair costs (often $75,000+)

- The risk of budget overruns and construction delays

- The stress of managing a complex project

- Paying real estate commissions

For many families, the emotional and financial relief of a quick, hassle-free cash sale provides more value than any potential extra profit from making repairs. It allows you to get immediate closure and focus on moving forward.

Conclusion: Moving Forward After the Fire

The question “can you sell a fire damaged house” has a clear answer: absolutely, yes. More importantly, you now understand that you have real options to move forward, each with its own advantages depending on your specific situation.

The path you choose – whether repairing first or selling as-is – isn’t about right or wrong decisions. It’s about what works best for your timeline, your budget, and your peace of mind. If you have the time, money, and emotional energy for a lengthy restoration process, repairing might maximize your financial return. But if you need to move forward quickly and avoid the stress of managing contractors and repairs, selling as-is offers immediate relief and certainty.

Throughout my 15+ years helping families steer these difficult situations, I’ve learned that the best solution is often the one that lets you sleep at night. Some homeowners find peace in restoring their property to its former glory. Others find freedom in walking away from the damage and starting fresh somewhere new.

Fire Damage House Buyer exists specifically for families who choose the second path. We understand that after everything you’ve been through – the trauma of the fire, dealing with insurance, finding temporary housing – the last thing you need is months of construction headaches and contractor coordination.

Our approach is straightforward: we buy your fire-damaged house exactly as it sits today. No repairs, no cleanup, no real estate agent commissions, and no lengthy waiting periods. Most importantly, we handle all the complexities so you don’t have to.

The fire may have damaged your house, but it doesn’t have to define your future. Whether you’re ready to sell immediately or still weighing your options, you’re not stuck. You have choices, you have support, and you have a clear path forward.