Fire Damage and Your Financial Protection: Understanding What’s Covered

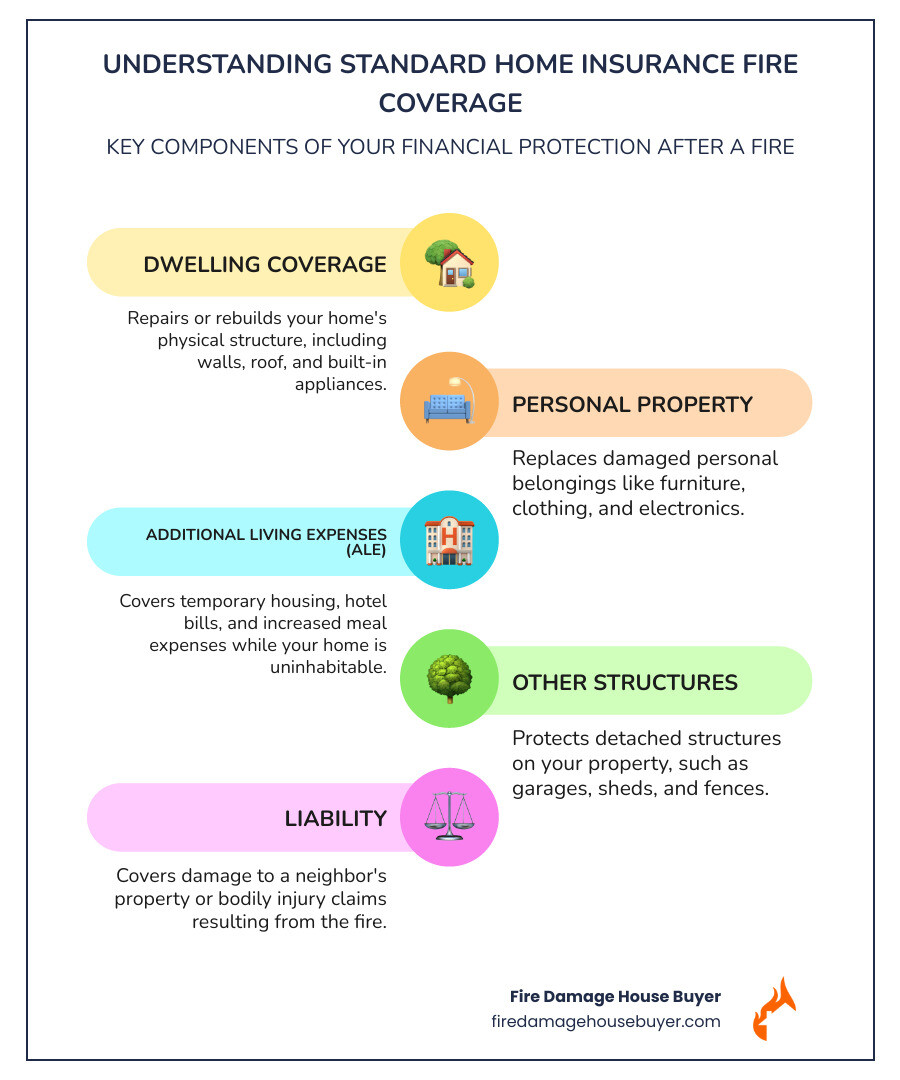

Does house insurance cover fire damage? Yes, standard homeowners insurance policies typically cover fire damage. This includes your home’s structure (dwelling coverage), personal belongings, other structures like garages, and additional living expenses if you’re displaced. It also provides liability protection. However, coverage can vary, and common exclusions include arson, fires in vacant properties, and gross negligence.

When disaster strikes, the shock of a house fire is overwhelming. Beyond the emotional trauma, you face urgent financial questions. Understanding your insurance coverage is critical to your recovery, but the process is often complex.

Fire damage restoration costs can range from $3,000 for minor incidents to over $100,000 for major damage. These figures don’t even account for temporary housing or replacing all your belongings. Many homeowners find their insurance payout doesn’t cover the full cost, leaving them with a significant financial gap.

I’m Daniel Cabrera, and with 16+ years in real estate, I’ve helped hundreds of homeowners steer the aftermath of a fire. I’ve seen how insurance can fall short and why exploring alternatives is often necessary. While insurance is vital, the path to recovery isn’t always straightforward.

What Fire Damage Is Covered by a Standard Home Insurance Policy?

When asking “does house insurance cover fire damage?”, many are surprised by how comprehensive the protection is. A standard policy addresses the full scope of a fire’s impact, from structural damage to the costs of living elsewhere during repairs.

Your policy acts as a set of safety nets: dwelling coverage for your home’s structure, personal property coverage for belongings, additional living expenses for temporary housing, and liability protection. Most policies also cover debris removal before rebuilding can begin.

Dwelling Coverage (Coverage A)

This is the core of your policy, handling the cost to rebuild or repair your home’s structure. It covers the walls, roof, floors, and built-in appliances like your furnace. Crucially, it also covers less obvious damage, such as smoke damage that permeates the house and water damage from firefighting efforts. Major structural repairs can cost $25,000 to $100,000 or more, making adequate dwelling coverage essential.

Personal Property Coverage

This protects the contents of your home: furniture, clothing, electronics, and other personal items. Your payout depends on whether you have Actual Cash Value (ACV), which pays the depreciated value of your items, or Replacement Cost (RCV), which pays to buy new items of similar quality.

An up-to-date home inventory list with photos is invaluable when filing a claim, as it provides proof of ownership and value to your adjuster.

Additional Living Expenses (ALE) / Loss of Use

If a fire makes your home unlivable, ALE coverage is a lifesaver. It covers the increased costs of living elsewhere, such as hotel bills, rent for temporary housing, and restaurant meals if you don’t have a kitchen. It also covers relocation expenses, like moving and storage costs. For more on navigating these challenges, see our guide on legal and financial considerations after fire.

Other Structures and Liability

Your policy also protects structures not attached to your house, like a detached garage, shed, or fence, under “Other Structures” coverage. More importantly, liability protection covers you if the fire damages a neighbor’s property or if someone is injured. This includes bodily injury claims and legal defense costs, providing critical financial protection against third-party claims.

So, Does House Insurance Cover Fire Damage from Any Cause?

While the answer to “does house insurance cover fire damage” is generally yes, the cause of the fire is critical. Fire is a standard covered “peril,” but policies have exclusions and limits that can lead to a claim denial or a payout that doesn’t cover the full cost of restoration, which can exceed $100,000 for major damage.

According to the National Fire Protection Association (NFPA) fire statistics, home fires are commonly caused by cooking, heating equipment, and electrical issues.

Typically Covered Fire Incidents

The good news is that most common house fires are covered. Insurers typically cover accidental fires, including:

- Kitchen fires from cooking accidents or malfunctioning appliances.

- Electrical fires caused by faulty wiring, overloaded circuits, or appliance malfunctions.

- Fireplace accidents from properly maintained fireplaces.

- Lightning strikes that ignite a fire.

Common Exclusions: When Fire Damage Is NOT Covered

Insurers include exclusions to prevent fraud and encourage responsible homeownership. A claim will likely be denied for:

- Arson and intentional acts: If you or a policyholder deliberately sets the fire.

- Vacant properties: If the home has been unoccupied for an extended period (typically 30-60 days), coverage may be voided.

- Gross negligence: Extreme carelessness, such as storing flammable materials improperly or ignoring known, severe hazards.

- Unaddressed maintenance issues: If a fire results from a known problem you failed to fix, it may be considered negligence.

What About Wildfires?

Does house insurance cover fire damage from wildfires? Generally, yes. Standard policies treat wildfire damage like any other fire. However, in high-risk states like California or Colorado, the insurance landscape is more challenging.

Insurers in these areas may charge higher premiums or deductibles. In some cases, they may limit coverage or require homeowners to seek a policy through a state-mandated FAIR Plan (Fair Access to Insurance Requirements), which offers last-resort coverage. Most policies, however, will still cover Additional Living Expenses if you are forced to evacuate due to a wildfire threat. If you live in a fire-prone area, review your policy for specific wildfire clauses and consider adding endorsements for extra protection.

How to Steer the Fire Damage Insurance Claim Process

After the fire is out, the insurance process begins. Filing your claim correctly is crucial for a smooth recovery and can make the difference between a fair payout and months of frustration. Understanding the process puts you in control.

The average insurance payout for a house fire can range from $50,000 to over $350,000, depending on the damage and your policy limits. Navigating the claim is key to maximizing what you receive.

Step-by-Step Guide to Filing Your Claim

The first 48 hours are critical. Follow these steps to protect your claim:

- Prioritize Safety: Do not re-enter your home until fire officials declare it safe.

- Contact Your Insurer Immediately: Report the fire as soon as possible to get the process started. Most insurers have 24/7 hotlines.

- Document Everything: Take extensive photos and videos of all damage before touching or moving anything. This is your primary evidence.

- Secure the Property: Prevent further damage by boarding up windows and tarping the roof. Keep receipts for these emergency repairs, as they are often reimbursable.

- Keep Detailed Records: Log every conversation with your insurer, including dates, names, and claim numbers. Keep all paperwork in a dedicated folder.

- Work with the Adjuster: Be present for the adjuster’s inspection, provide your documentation, and point out all areas of damage.

For a more detailed walkthrough, Get our comprehensive fire damage insurance claims guide.

Understanding Your Payout: ACV vs. Replacement Cost

Your payout amount is heavily influenced by whether your policy uses Actual Cash Value (ACV) or Replacement Cost (RCV).

- Actual Cash Value (ACV) pays for the value of your damaged property minus depreciation. You get what it was worth at the time of the fire.

- Replacement Cost (RCV) pays the full cost to replace the item with a new one of similar quality. This coverage has higher premiums but provides a better payout.

| Feature | Actual Cash Value (ACV) | Replacement Cost (RCV) |

|---|---|---|

| Payout Basis | Depreciated value at time of loss | Cost to replace with new item today |

| Depreciation | Deducted from replacement cost | Not deducted |

| Premium Cost | Lower monthly payments | Higher monthly payments |

| Claim Process | Single payout after claim approval | Often two-stage payment process |

Your policy limits (the maximum your insurer will pay) and deductible (the amount you pay out-of-pocket) also determine your final check. If repair costs exceed your limit, you are responsible for the difference. This financial gap is a primary reason many homeowners explore alternatives to rebuilding.

When Your Insurance Payout Isn’t Enough

A harsh reality of fire recovery is that the insurance payout often doesn’t cover the full cost of rebuilding. This financial shortfall, known as the underinsurance gap, can be staggering and leaves families in a difficult position while already dealing with emotional trauma.

Several factors contribute to this gap:

- Outdated Coverage: If your policy limits haven’t kept pace with rising construction costs and your home’s increased value, you could be short tens of thousands of dollars.

- High Deductibles: A deductible of $5,000 or $10,000 means you’re paying a significant amount out-of-pocket before your coverage even begins.

- Disputed Claims & Slow Payouts: Insurers may dispute the cause or extent of damage, leading to lengthy negotiations and delays. This slow process can be a financial nightmare, as you’re often paying for temporary housing and a mortgage on an uninhabitable home.

- Unexpected Costs: Initial estimates often miss hidden issues like structural problems, persistent smoke odor, or mold from firefighting water. These surprises can quickly exceed your policy limits, as fire damage restoration can cost from $25,000 to over $100,000.

- The Rebuilding Ordeal: Managing contractors, dealing with delays, and making countless decisions adds immense stress. The emotional and logistical toll of coordinating a rebuild is a full-time job that many homeowners are unprepared for.

When facing these challenges, it’s important to know all your options. Explore our Fire Damage Resources for additional guidance during this difficult time.

A Simpler, Faster Alternative: Selling Your Fire-Damaged House

For many, the best path forward isn’t rebuilding. The endless cycle of insurance adjusters, contractor estimates, and reconstruction decisions is exhausting. There is a way to skip the stress and move on with your life immediately.

Instead of worrying if your insurance will be enough, you can sell your fire-damaged house directly to us. We give you the freedom to close this difficult chapter and start fresh.

Our process is straightforward: we buy your house as-is. You don’t need to clean up debris or make a single repair. We provide a fair cash offer with no real estate commissions and can close on your timeline, often in just a few weeks. This gives you immediate access to funds when you need them most.

This alternative is especially powerful if you’re facing an underinsurance gap or a high deductible. Rather than taking on the financial burden and months of construction chaos, you can sell and move forward. The emotional relief is immense—no more sleepless nights or arguments with adjusters. You can take your insurance payout, add our cash offer, and find a new, move-in-ready home.

To see if this is the right solution for you, Learn about our simple process and how we help homeowners find a fresh start.

Frequently Asked Questions about Fire Damage and Insurance

Here are answers to the most common questions homeowners have after a fire.

Does house insurance cover fire damage from smoke?

Yes. Standard home insurance policies cover smoke damage, which is often one of the most pervasive and costly parts of a fire. Smoke can travel throughout the entire home, leaving soot and a persistent odor. Your policy’s dwelling coverage handles cleaning or repairing walls and ceilings, while personal property coverage addresses smoke-damaged belongings, which may need professional cleaning or full replacement.

How does house insurance cover fire damage differently than flood damage?

This is a critical distinction. Fire is a standard “peril” included in virtually every homeowners policy. Flood damage, however, is specifically excluded. To be covered for damage from rising water (like from a storm surge or overflowing river), you must purchase a separate flood insurance policy, typically through the National Flood Insurance Program (NFIP) or a private insurer.

What if my fire damage claim is denied?

A claim denial is devastating, but it’s not always the final word. You have the right to appeal. First, demand a detailed written explanation for the denial from your insurer. Review your policy against their reasoning and gather any additional evidence. You can then file an internal appeal. If that fails, contact your state’s Department of Insurance for assistance or consult an attorney specializing in insurance claims. The appeals process can be long and stressful, which is why many homeowners choose to sell their damaged house for cash to avoid the fight.

Your Next Step After a House Fire

We’ve seen that the answer to “does house insurance cover fire damage?” is complex. Even with good coverage, the path forward is challenging. Fire damage restoration costs can easily exceed $100,000, and many homeowners find their insurance payout falls short, leaving them with a significant financial burden.

The rebuilding journey is often long and emotionally draining, filled with contractor negotiations, unexpected costs, and endless decisions. These challenges can stretch on for months, putting your life on hold.

Sometimes, the best path forward isn’t rebuilding—it’s starting fresh. We’ve seen countless families find peace by selling their fire-damaged house as-is.

When you sell to Fire Damage House Buyer, you choose simplicity. With no repairs, no commissions, and a fast cash closing, you can move forward on your timeline. We handle the damaged property so you can focus on your recovery. This isn’t just about avoiding a hassle; it’s about reclaiming control of your life. You can read our reviews from homeowners we’ve helped to see how this choice transformed their journey.

Your next step doesn’t have to be overwhelming. If you’re facing insurance complications or simply want to move on without the stress of rebuilding, we offer a straightforward solution. For more insights, explore our blog for more helpful articles. The fastest way to rebuild your life is often to start somewhere new.