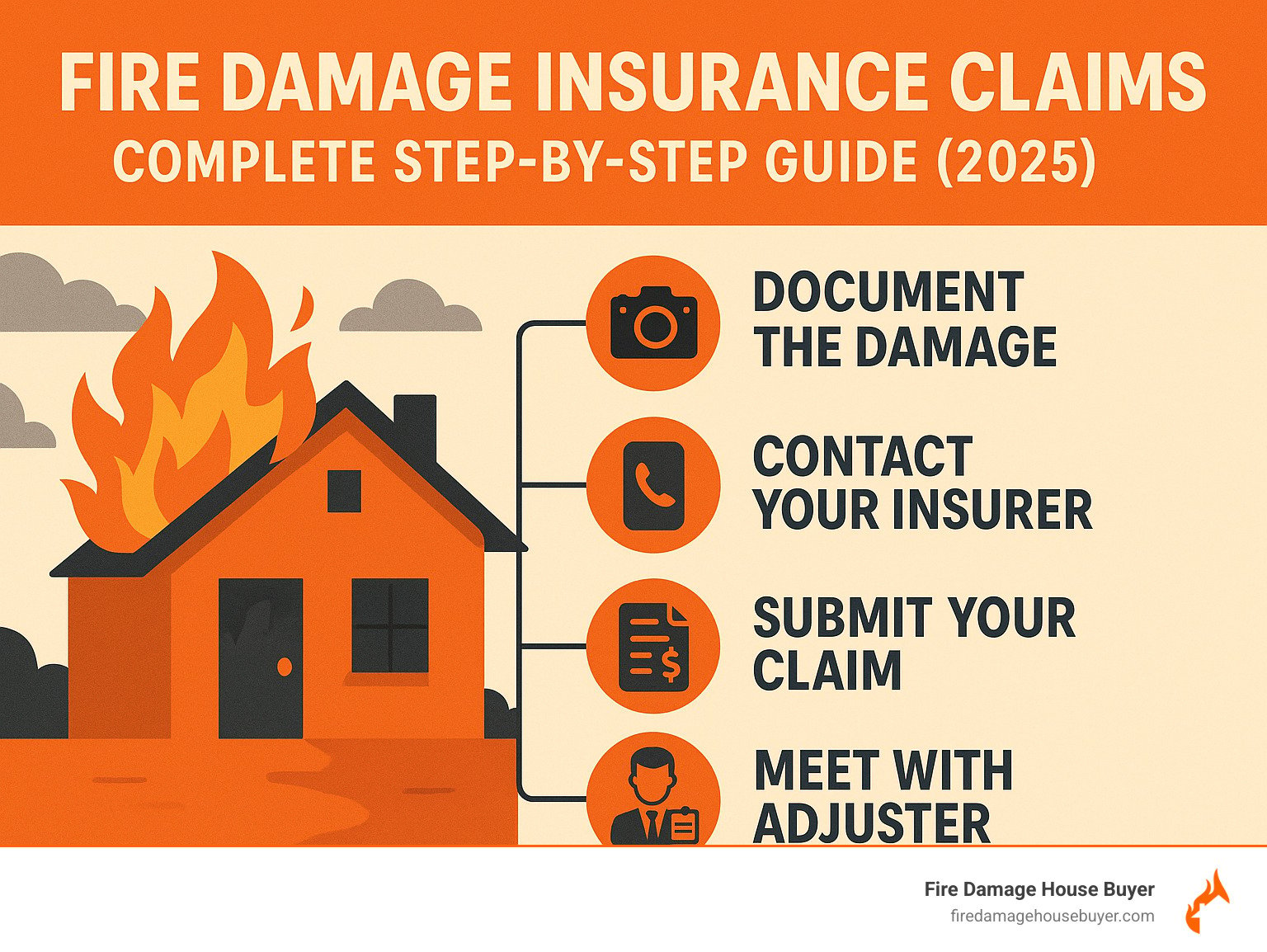

Step-by-Step Guide to Fire Damage Insurance Claims

Navigating the Path to Recovery After a Fire

Fire Damage Insurance Claims: Complete Step-by-Step Guide [year]

- Immediate Steps (First 24-48 Hours)

- Ensure personal safety and only re-enter with official clearance

- Contact your insurance company to initiate your claim

- Document all damage with photos/videos before cleanup

- Secure your property (board up windows, tarp roof)

- Documentation & Claim Filing

- Create a detailed inventory of damaged/lost items

- Obtain the official fire department report

- Submit proof of loss within your policy’s deadline (usually 30-60 days)

- Track all additional living expenses with receipts

- Working with Adjusters

- Prepare for the insurance adjuster’s inspection

- Get independent contractor estimates for comparison

- Understand the difference between Actual Cash Value (ACV) and Replacement Cost Value (RCV)

- Consider hiring a public adjuster for claims over $10,000

“A house fire can transform your life in mere minutes, leaving behind not just damaged property, but shattered peace of mind and countless questions about what comes next,” notes insurance specialist Karl Susman.

I’m Daniel Cabrera, founder of Fire Damage House Buyer with over 15 years of experience helping homeowners steer the complexities of Fire Damage Insurance Claims: Complete Step-by-Step Guide [year] while offering solutions for those who prefer to sell their fire-damaged properties rather than rebuild. Having personally guided hundreds of homeowners through this process, I understand the emotional and financial challenges you’re facing.

Immediate Safety, Mitigation & Documentation

Prioritizing Safety First

The smoke has cleared, but your journey is just beginning. Before you take a single step toward recovery, please remember that your family’s wellbeing comes first.

Never—and I mean never—enter your fire-damaged home until fire officials have given you the green light. Even when the flames are gone, danger lingers. Recent studies from the Safe Community Project show that smoke particles can cause serious health issues long after the fire is extinguished.

When you do get permission to re-enter, dress the part: an N95 respirator mask to protect your lungs, thick gloves to shield your hands, sturdy boots to protect your feet from sharp debris, and clothing that covers your arms and legs completely.

As insurance expert Douglas Heller wisely puts it, “The better you document what you are doing as you go through this awful time, the easier it will be to demonstrate your claim for reimbursements.” These words might seem simple, but they’re your north star in the days ahead.

Emergency Mitigation Steps

Once safety is confirmed, your home needs immediate protection from further harm. Your insurance typically covers these emergency measures (yes, keep every receipt!), so don’t hesitate to:

Secure your property by boarding up broken windows and doors. This prevents unwelcome visitors—both human and weather-related—from causing additional damage.

Protect your home from the elements by tarping damaged roof areas. A single rainstorm can turn minor fire damage into a major moisture and mold catastrophe.

Prevent secondary disasters by turning off utilities. If there’s even a hint of gas leaks or electrical issues, shut everything down until professionals give you the all-clear.

Crucial Documentation Process

Your smartphone might just become your most valuable tool right now. Thorough documentation is the foundation of a successful Fire Damage Insurance Claims process.

Start by obtaining the fire department report. This official document isn’t just paperwork—it’s validation of what happened and will be crucial for your claim.

Next, photograph and video everything. I’m talking about wide shots of each room followed by close-ups of individual items. Use natural light when possible, include something for scale (like a ruler), and narrate your videos as you go. “This is the master bedroom, facing north. The smoke damage extends across the entire ceiling…” Enable date and time stamps on all your media.

Create a detailed inventory by methodically going room by room. Be specific—incredibly specific. A homeowner in Georgia found success by documenting items like: “Brown leather three-seat Pottery Barn Webster sofa, purchased March 2019 for $2,400, extensive smoke and water damage, located in living room.” This level of detail made a significant difference in their settlement.

Finally, get multiple contractor estimates. Three independent assessments from licensed professionals will give you leverage when negotiating with your insurance company.

One crucial tip that many homeowners learn the hard way: back up all your documentation to cloud storage immediately. Fire-damaged devices have an unfortunate habit of failing after initial use, taking irreplaceable evidence with them.

For a complete checklist to help you stay organized during this overwhelming time, check out our Fire Damaged House Selling Checklist. And if you’re concerned about health risks, the scientific research on smoke-inhalation risks provides valuable information to keep your family safe.

Proper documentation isn’t just about getting what you deserve from your insurance claim—it’s about creating a clear path forward during one of life’s most challenging moments.

What Your Policy Covers & Key Insurance Terms

Understanding your insurance policy isn’t just helpful – it’s essential for getting what you’re entitled to after a fire. Let’s break down the confusing insurance language into plain English so you can steer your Fire Damage Insurance Claims: Complete Step-by-Step Guide [year] with confidence.

Dwelling Coverage (Coverage A)

This is the foundation of your policy – it covers the actual structure of your home and anything attached to it. Most insurers require you to insure at least 80% of your home’s replacement value (though I always recommend 100% coverage for full protection).

Your dwelling coverage includes repairs to walls, floors, ceilings, roof, and foundation. It also covers built-in appliances, cabinets, and fixtures that are permanently installed. That attached garage? Covered here too.

“Many homeowners don’t realize their dwelling coverage needs to increase regularly to keep pace with rising construction costs,” says insurance expert Maria Chen. “After a fire, the last thing you want to find is that you’re underinsured.”

Personal Property (Coverage C)

This protects all the stuff that would fall out if you turned your house upside down and shook it. Your furniture, clothing, electronics, kitchenware – everything you own. Most policies set personal property coverage at 50-70% of your dwelling coverage.

For example, if your home is insured for $300,000, you might have between $150,000 and $210,000 to replace your belongings. This is why creating that detailed inventory we discussed earlier is so important – many people don’t realize how quickly the value of their possessions adds up until they’ve lost everything.

Additional Living Expenses (Coverage D)

Also called “loss of use,” this might become your financial lifeline after a fire. When your home is uninhabitable, this coverage pays for the extra costs of living elsewhere. This includes hotel stays, apartment rentals, restaurant meals (beyond what you’d normally spend on food), laundry services, pet boarding, storage fees, and even increased commuting costs.

Karl Susman, a respected insurance advisor, emphasizes: “Get your claim filed as quickly as you can. You don’t have to have all of the information on hand.” This is especially crucial for accessing your ALE benefits promptly when you need immediate housing.

Debris Removal

Before rebuilding can begin, the charred remains must be cleared away. Most policies cover this necessary step, typically up to 25% of the amount allocated to the damaged property. This coverage is often overlooked but can represent thousands of dollars in necessary cleanup costs.

Understanding Key Insurance Terms

Actual Cash Value (ACV) vs. Replacement Cost Value (RCV)

This distinction can literally make or break your financial recovery:

| Feature | Actual Cash Value (ACV) | Replacement Cost Value (RCV) |

|---|---|---|

| Definition | Original cost minus depreciation | Cost to replace with new item |

| Example | 5-year-old fridge bought for $1,500 valued at $750 | Full $1,500 replacement cost |

| Payout timing | Single payment | Initial ACV payment, then remainder after replacement |

| Premium cost | Lower | Higher |

| Best for | Budget-conscious homeowners | Maximum recovery |

The difference is substantial. Consider a living room sofa purchased five years ago for $1,200. Under ACV, you might receive just $500 after depreciation. With RCV, you’d get the full cost of a comparable new sofa – perhaps $1,500 in today’s market.

Common Policy Exclusions

Even the best insurance policies have limitations. Standard policies typically won’t cover:

- Intentional acts (arson)

- Properties vacant for extended periods (typically 30+ days)

- Gradual damage or wear and tear

- Business equipment (may require separate coverage)

- Certain valuable items without special endorsements

If your home was damaged in a wildfire, coverage is typically included, but it’s worth checking if your policy has special wildfire endorsements, particularly in high-risk areas.

Sub-limits and Deductibles

Your policy likely contains “fine print” that limits coverage for certain categories:

Your jewelry might be limited to $1,000-$2,000 total, regardless of actual value. Electronics often have per-item limits. Art, collectibles, and antiques usually have strict caps unless specifically scheduled.

And don’t forget about your deductible – the amount you’ll pay out-of-pocket before insurance kicks in, typically $500-$2,500 for fire claims.

For a deeper understanding of the damage fire can cause to your home’s structure, check out How Hot Does a House Fire Get?. The temperatures reached during a house fire directly impact what can be salvaged and what must be replaced.

According to scientific research on filing claims, homeowners who thoroughly understand their policy terms before negotiating with insurers typically receive settlements 15-30% higher than those who don’t.

Fire Damage Insurance Claims: Complete Step-by-Step Guide [year]

Now that you understand the basics, let’s walk through the complete process of filing and managing your Fire Damage Insurance Claims: Complete Step-by-Step Guide [year].

Fire Damage Insurance Claims: Complete Step-by-Step Guide [year] – Filing Your Claim Day 1

The first 24 hours after a fire are critical for your insurance claim. Take a deep breath – I know this is overwhelming, but you can do this one step at a time.

1. Notify Your Insurer Immediately

Pick up the phone within 24-48 hours of the fire. This isn’t just good practice – most policies actually require prompt notification and may deny claims filed too late.

During this first call, have your policy number handy and share basic details about when and how the fire occurred. Don’t worry about having all the answers yet. Ask about immediate living expense advances – you need a place to stay tonight, after all! Make sure to write down your claim number and get your adjuster’s direct contact information.

I’ve seen this firsthand: Insurance Commissioner Lara of California recently mandated that “insurance companies pay at least two weeks of ALE benefits to evacuees and provide an advance payment for no less than four months of ALE without an itemized inventory form.” This can be a financial lifeline when you need it most.

2. Begin Documenting Temporary Expenses

That $200 hotel room? The clothes you had to buy because yours smell like smoke? The extra gas you’re using driving back and forth? These are all potentially reimbursable expenses.

Start a dedicated folder (physical or digital) for every receipt. Even small purchases add up quickly, and without documentation, you’ll lose out on rightful reimbursement. I’ve worked with homeowners who recovered thousands in additional expenses they would have otherwise forgotten about.

3. Start a Claim Diary

Trust me on this one – your claim will involve dozens of conversations over the coming weeks. Start a simple log noting who you spoke with, when you talked, what was discussed, and any promised next steps.

This diary becomes invaluable when someone says, “I never told you that” or “You were supposed to send that form two weeks ago.” Your detailed records will protect you and keep your claim moving forward.

4. Make Temporary Repairs Only

Your home needs immediate protection from further damage, but now isn’t the time for full repairs. Focus only on emergency measures:

Board up broken windows, tarp damaged roof areas, and remove standing water to prevent mold. Take plenty of “before” photos, then more photos after these temporary fixes. Keep every receipt for materials and labor – these emergency measures are almost always covered by your policy.

Fire Damage Insurance Claims: Complete Step-by-Step Guide [year] – Working With the Insurance Adjuster

The insurance adjuster’s visit is a pivotal moment in your claim process. Preparation makes all the difference.

1. Prepare for the Adjuster’s Visit

Before the adjuster arrives, arm yourself with knowledge. Review your policy so you understand your coverage limits and exclusions. Organize your documentation and photos in a logical way – I recommend room-by-room folders. Have your inventory list as complete as possible, and if you’ve already gotten contractor estimates, have those printed and ready.

The more prepared you appear, the more seriously your claim will be taken. I’ve seen adjusters spend twice as long at well-prepared homes simply because they recognize the homeowner has done their homework.

2. Understand the Adjuster’s Role

Here’s something many homeowners don’t realize: the company adjuster works for the insurance company, not for you. Their job includes verifying the cause is covered, assessing damage, estimating costs, and recommending a settlement amount.

Between you and me, insurance adjusters typically start negotiations at 50-75% of their authorized settlement amount for fire damage claims. This isn’t because they’re dishonest – it’s just how the system works. They expect some negotiation.

3. Get the Scope of Loss Document

After inspection, ask for a copy of the “scope of loss” document. This detailed report outlines damaged areas, required repairs, line-by-line cost estimates, and depreciation calculations.

Review it with the attention of a tax auditor. I’ve helped homeowners who found entire rooms missing from these reports, or repair estimates that were laughably below market rates. Your careful review can add thousands to your settlement.

4. Obtain Independent Assessments

Never rely solely on the insurer’s assessment. Get multiple contractor estimates from businesses you’d actually hire for the work. Consider bringing in specialists – a structural engineer for potential foundation damage or a restoration expert for smoke damage assessment.

These independent opinions provide leverage when the insurance company’s numbers seem low. One family I worked with received an additional $23,000 after a structural engineer identified hidden damage the adjuster had missed.

5. Consider a Public Adjuster for Complex Claims

For significant losses over $10,000, a public adjuster can be worth their weight in gold. These licensed professionals work exclusively for you, typically charging 9-15% of the settlement. While that might sound steep, they often secure settlements 30-40% higher than homeowners negotiating alone.

They handle all documentation, negotiation, and follow-up, allowing you to focus on rebuilding your life. For complex claims, their expertise often pays for itself many times over.

Tracking ALE, Supplemental & Hidden Damage

1. Additional Living Expenses (ALE) Management

Your temporary living situation is likely costing more than your normal life did. Create a simple system for tracking these expenses – a dedicated folder for receipts and a spreadsheet categorizing each expense by type.

Submit these expenses weekly rather than waiting for a large batch. This keeps reimbursement money flowing and helps prevent financial strain. Remember to document your pre-fire living costs for comparison – the insurance covers the difference between your normal expenses and your temporary situation.

2. Identifying Hidden Damage

Fire damage is sneaky. What looks fine today might show problems months later. Smoke can infiltrate HVAC systems, water from firefighting efforts can seep behind walls, and intense heat can compromise structural elements.

Professional assessments using thermal imaging cameras, moisture meters, and air quality testing can identify these hidden issues before they worsen. Don’t hesitate to bring in specialists – their reports provide crucial documentation for supplemental claims.

3. Filing Supplemental Claims

When new damage appears, don’t panic – file a supplemental claim. Document the newly finded issues with photos and professional assessments, then request an adjuster reinspection.

I worked with a family who finded water damage in their attic two months after their initial settlement. By properly documenting and filing a supplemental claim, they received an additional $12,000 for repairs they would have otherwise paid out-of-pocket.

4. Keep Your Claim Open

Patience pays off with fire claims. I recommend keeping your claim open for at least six months, as damage can continue to manifest over time. Most policies allow for supplemental claims within a specific timeframe after the initial incident.

This process is a marathon, not a sprint. Taking the time to thoroughly document and address all damage – even what’s not immediately visible – ensures you receive the full compensation you deserve under your policy.

If the claims process becomes too overwhelming or you’re considering alternatives, learn more about our quick cash offer for fire-damaged homes. Sometimes selling as-is provides the fresh start many homeowners need.

Negotiating, Disputing & Maximizing Your Settlement

The moment of truth arrives when you receive that initial settlement offer. Often, this is where the real work begins. Insurance companies naturally aim to minimize payouts—it’s simply business for them—while you need fair compensation to rebuild your life after such a devastating event.

Preparing Your Counteroffer

When that first offer lands in your inbox and your heart sinks because it seems woefully inadequate, don’t panic. This is completely normal in the Fire Damage Insurance Claims: Complete Step-by-Step Guide [year] process.

Start by carefully analyzing the adjuster’s scope of loss document line by line. Compare their numbers with your contractor estimates—those independent assessments really shine here. Document any discrepancies you find with your photos and expert opinions. Then, prepare a detailed, written counteroffer that clearly explains why you deserve more.

“Insurance companies do not profit from paying claims, and will likely assert whatever defense they believe will absolve or mitigate their coverage obligations,” notes one insurance attorney I interviewed. This hard truth underscores why thorough preparation matters so much when you’re fighting for fair compensation.

When to Consider Professional Help

There comes a point when bringing in the cavalry makes sense. Consider hiring a public adjuster if your claim exceeds $10,000, involves significant structural damage, or includes complex smoke or water damage issues. They’re also invaluable when your insurer is dragging their feet or if you simply lack the time or expertise to manage this overwhelming process.

Yes, public adjusters typically charge between 9-15% of your settlement amount. That might sound steep, but research consistently shows they secure significantly larger settlements than policyholders who try to steer these choppy waters alone. For many homeowners I’ve worked with, that fee quickly pays for itself.

Using the Appraisal Clause

Buried in the fine print of most insurance policies is a valuable tool called the “appraisal clause.” Think of it as arbitration-lite for resolving claim disputes without the expense and time of a lawsuit.

Here’s how it works: You hire an independent appraiser, the insurer hires theirs, and then these two appraisers select a neutral umpire. Whatever the majority decides becomes binding. This process typically resolves disputes faster and with less expense than litigation, making it worth exploring before calling an attorney.

Recognizing Bad Faith Insurance Practices

Sometimes, the problem goes beyond simple disagreement about numbers. Watch for signs that your insurer might be operating in bad faith: unreasonable delays in processing your claim, failure to investigate properly, misrepresentation of policy provisions, making lowball offers with no justification, or engaging in threatening or coercive behavior.

If you encounter these practices, document everything carefully. Note every phone call, save every email, and consider consulting an attorney who specializes in insurance bad faith claims. These specialists often work on contingency, meaning they only get paid if you win.

Maximizing Your Settlement

After helping hundreds of homeowners through this process, I’ve seen certain strategies consistently lead to better outcomes. Document everything with obsessive detail. Get multiple independent estimates from respected contractors. Identify all categories of loss—not just the obvious structural damage, but also contents, landscaping, and other affected areas.

For unique or valuable items like art, collectibles, or antiques, hire specialists to provide proper valuations. Track every additional expense from storage fees to temporary housing costs. And when amounts are disputed, request line-item explanations to understand exactly where the disagreement lies.

Persistence pays off. One homeowner I worked with initially received an offer of $87,000 for extensive fire damage. After methodically working through these steps and bringing in a public adjuster, her final settlement topped $215,000—more than double the initial offer.

If the negotiation process becomes too stressful or the damage too extensive, some homeowners ultimately decide that selling their fire-damaged property “as-is” makes more sense than fighting through the rebuilding process. For those considering this option, Fire Damaged House Buyer Reviews offers insights from homeowners who chose this path.

Recent scientific research on claims-satisfaction decline shows that homeowner satisfaction with insurance claims has dropped significantly in recent years, making it all the more important to advocate strongly for yourself throughout this process.

The settlement negotiation phase of your Fire Damage Insurance Claims: Complete Step-by-Step Guide [year] journey may feel like climbing a mountain, but with preparation, persistence, and the right help when needed, you can reach a fair resolution and begin rebuilding your life.

Conclusion & Next Steps

Life after a house fire can feel like an uphill battle. Between insurance paperwork, temporary housing, and tough decisions about your future, it’s easy to feel overwhelmed. The good news? With proper documentation, a solid understanding of your policy, and a healthy dose of persistence, you can secure a fair settlement and start rebuilding your life.

Considering Your Options

After the smoke clears, you’ll face a crossroads that many homeowners before you have contemplated: rebuild or sell? Both paths have their merits, and the right choice depends entirely on your unique situation.

If you’re leaning toward rebuilding, you’ll appreciate staying in your familiar neighborhood and community. Many homeowners find comfort in maintaining their roots while having the opportunity to upgrade their home with modern features during reconstruction. Plus, your insurance typically covers most rebuilding costs, making this a financially viable option for many.

On the flip side, selling your fire-damaged property offers its own set of advantages. Many of our clients choose this route because it provides immediate closure and a clean break from a traumatic experience. You’ll skip the headaches of managing contractors and the months-long rebuilding process. Instead, you gain quick access to funds that can help you start fresh elsewhere without the lingering reminders of what happened.

“After our fire, the thought of spending a year rebuilding while living in a rental was just too much,” shares Maria from Colorado. “Selling our damaged home gave us the financial freedom to move closer to family who could support us through this transition.”

At Fire Damage House Buyer, we’ve helped hundreds of homeowners who chose to sell rather than rebuild. We offer cash purchases with no repairs needed, no commissions, and fast closing times across all 50 states. Our process is designed to reduce stress during an already challenging time in your life.

How long do I have to file a fire damage claim?

Time limits for filing claims aren’t one-size-fits-all. Most policies require “prompt” notification, typically within 24-48 hours of the fire. For submitting your formal proof of loss, you’ll usually have 30-60 days. That some states have laws that extend these deadlines, offering additional protection for policyholders.

The most important thing? Don’t wait. As insurance specialist Karl Susman wisely advises, “Get your claim filed as quickly as you can. You don’t have to have all of the information on hand.” You can always supplement your claim with additional details as you gather them.

I once worked with a family who waited three weeks to file their claim because they wanted to create a “perfect” inventory list first. Their insurer initially denied the claim for late reporting, creating an unnecessary battle that could have been avoided with a simple phone call right after the fire.

What if my claim is denied or underpaid?

A denied or underpaid claim isn’t necessarily the end of the road. Start by requesting a written explanation of the denial or settlement calculation—this gives you specific points to address. Then, review your policy with a fine-tooth comb to understand exactly what should be covered.

Gathering additional evidence often turns the tide in your favor. This might include more detailed contractor estimates, expert opinions on smoke damage, or additional photos documenting the extent of your loss. Submit this evidence with a formal appeal to your insurance company.

If you’re still hitting a wall, contact your state insurance department for guidance. Many states have consumer advocacy divisions specifically designed to help policyholders steer disputes. For complex or high-value claims, considering a public adjuster or attorney might be your best investment.

The persistence pays off. Just last year, I worked with a homeowner whose $85,000 claim was initially denied due to “pre-existing conditions.” After gathering three independent contractor assessments and filing an appeal, his insurer reversed the decision and approved the full amount.

Will filing a fire claim raise my premiums?

I won’t sugarcoat it—filing a fire claim will likely impact your insurance rates. Most insurers increase premiums after a significant claim, with these increases typically lasting 3-5 years. Multiple claims in a short period might even lead to non-renewal when your policy term ends.

Some states have regulations limiting how much your rates can increase following a claim, offering some protection against dramatic spikes. However, don’t let concerns about premium increases deter you from filing a legitimate claim. That’s precisely why you’ve been paying those premiums all along—to have coverage when disaster strikes.

It’s worth noting that customer satisfaction with homeowners insurance property claims declined to a 7-year low in 2024, amid record catastrophic events and slower-than-ever repair times. This trend makes thorough documentation and persistence even more critical for claim success in today’s challenging insurance landscape.

If the Fire Damage Insurance Claims: Complete Step-by-Step Guide [year] process feels too daunting, you have options. Our team at Fire Damage House Buyer specializes in offering fair cash offers for fire-damaged homes in any condition, providing a stress-free alternative to the lengthy rebuilding process.

Whether you choose to rebuild or sell, the key is making an informed decision that serves your family’s needs during this challenging time. After all, recovering from a fire isn’t just about restoring property—it’s about rebuilding your sense of security and moving forward with confidence.