Understanding Your Options After a Fire Disaster

A fire public adjuster is a licensed insurance professional you can hire to represent your interests when settling a fire damage claim with your insurance company. Unlike the adjuster sent by your insurer, a public adjuster works exclusively for you, handling everything from damage assessment to negotiation—typically for a fee of 10-15% of your final settlement.

Quick Answer: What You Need to Know About Fire Public Adjusters

- Who they work for: You, the policyholder (not the insurance company)

- What they do: Assess damage, interpret your policy, document losses, and negotiate your settlement

- What they cost: Usually 10-15% of your total claim payout

- When to hire one: After a fire when claims are complex, denied, or settlement offers seem too low

- Key benefit: Professional expertise in maximizing your insurance recovery

- Main drawback: Fees reduce your net payout, and the process still takes months

Dealing with a fire’s aftermath is overwhelming. Beyond the emotional trauma and financial pressure, you face a complex insurance claim that can last for months. Your insurer sends their own adjuster, who works for them. A fire public adjuster is your advocate, promising to level the playing field and fight for the compensation you deserve.

However, even with a public adjuster, the process remains long and stressful. Restoration costs for fire damage typically range from $20,000 to $150,000, with total rebuilds sometimes exceeding $500,000. After the public adjuster’s fee, deductibles, depreciation, and coverage gaps, the money for repairs can fall short. You’ll still face extensive documentation, negotiations, and uncertain timelines while displaced from your home.

Many homeowners assume hiring a fire public adjuster guarantees a better outcome, but it’s not always that simple. They are bound by your policy’s limits and can’t create non-existent coverage or speed up payments. Meanwhile, you’re still managing contractors and living in temporary housing as the claim drags on.

As Daniel Cabrera, founder of Fire Damage House Buyer, I’ve seen for over 15 years how restoration and insurance complications leave families exhausted and financially strained—even with a skilled fire public adjuster. That’s why I want you to understand the full reality of the claims and restoration process, so you can make the best decision for your family’s situation.

Understanding the Role of a Fire Public Adjuster

When a fire devastates your home, the path to recovery often feels like a winding road through unfamiliar territory. This is where a fire public adjuster steps in, acting as your personal guide and advocate. Their primary role is to represent your interests, ensuring you receive a fair and complete settlement from your insurance company. They are not beholden to the insurer; their loyalty is solely to you, the policyholder.

What a Fire Public Adjuster Does for You

A public adjuster manages the complex details of your fire damage claim so you can focus on rebuilding your life. Their services include:

- Policy Analysis: They analyze your dense insurance policy to identify all coverages, limits, and exclusions. This helps you understand your rights and can uncover overlooked benefits, such as coverage for building code upgrades.

- Damage Assessment: They conduct an independent, thorough evaluation of all damages, including structural issues, smoke and soot contamination, and water damage from firefighting. We’ve seen how crucial it is to thoroughly document fire damage for claims to build a strong case.

- Claim Preparation: The public adjuster compiles a comprehensive claim file with detailed repair estimates, evidence of all damage, a complete contents inventory, and support for additional living expenses (ALE). This documented claim is then presented to your insurer. For a broader understanding of their role, you can explore What is a public adjuster?.

- Negotiation: As seasoned negotiators, they engage directly with your insurance company to dispute low offers or denials, using the detailed documentation to push for the maximum possible settlement under your policy.

- Settlement Management: Once a settlement is reached, they help oversee the process to ensure funds are released correctly and promptly, acting as a bridge between you and the insurer to aim for a faster, larger settlement.

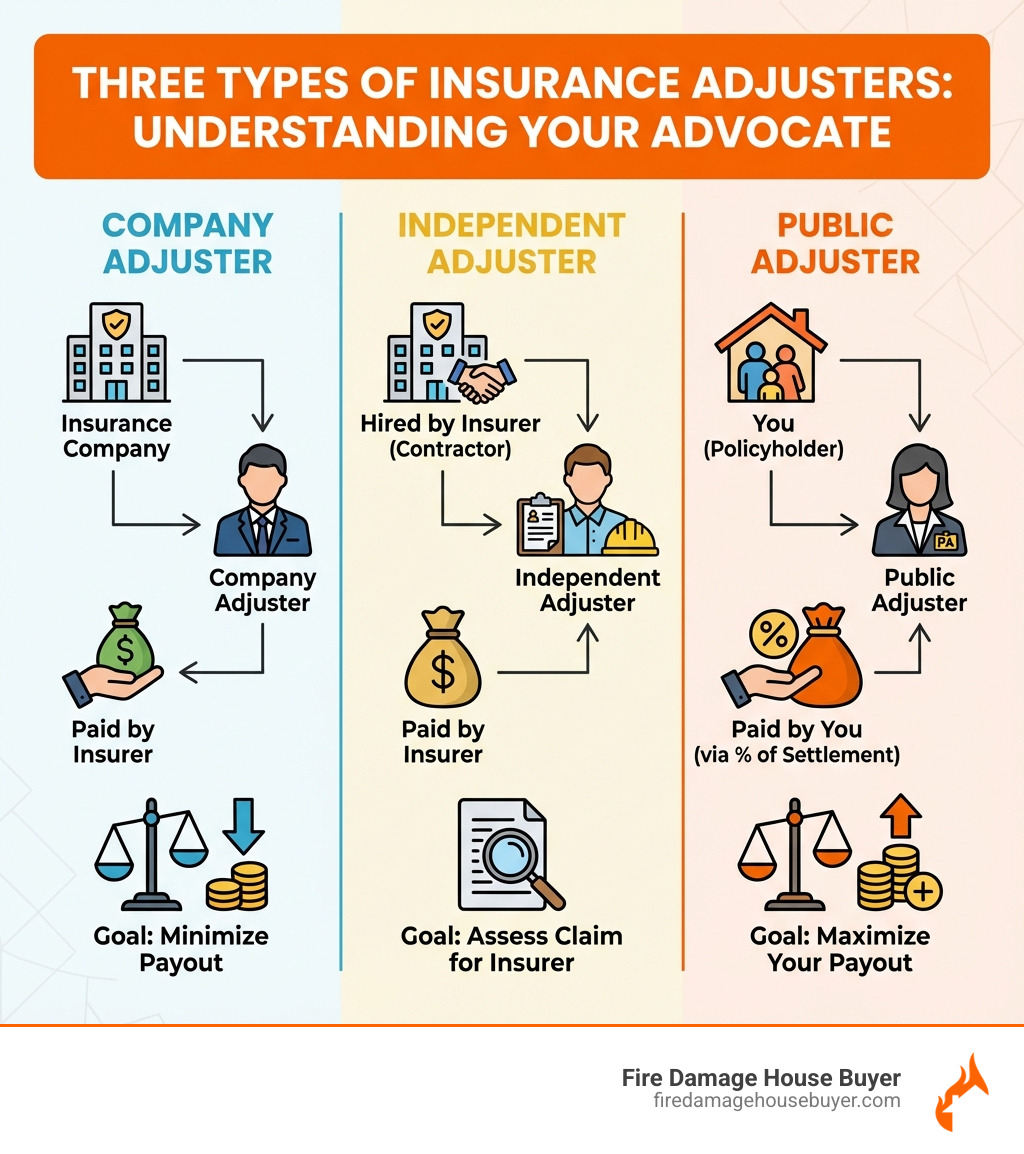

The Difference Between Adjusters

It’s easy to get confused by the different types of adjusters you might encounter after a fire. Here’s a quick breakdown to clarify who works for whom:

| Aspect | Public Adjuster | Company Adjuster (Staff/Independent) |

|---|---|---|

| Who They Work For | You, the policyholder | The insurance company |

| Who Pays Them | You, via a percentage of your settlement | The insurance company |

| Primary Goal | Maximize your settlement payout | Minimize the insurance company’s payout |

| Loyalty | Exclusive to the policyholder | Exclusive to the insurance company |

| Cost to You | Typically 10-15% of settlement | None (part of your premium) |

As you can see, the fundamental difference lies in allegiance. A company or independent adjuster, while professional, ultimately serves the interests of the insurance company that employs or contracts them. A public adjuster, on the other hand, is your dedicated advocate.

How They Help with Your Policy and Documentation

A fire public adjuster excels at policy details and damage documentation:

- Policy Interpretation: They decipher dense policy language to prevent missed deadlines or misinterpreted exclusions that could cost you thousands. They find coverage for items like mandatory building code upgrades, which can significantly increase settlements.

- Identifying Hidden Damages: Fire damage isn’t just what’s burned. Smoke and soot cause corrosive damage and odors, and we often see extensive Smoke Contamination After Fire that homeowners might underestimate. A public adjuster has the expertise to identify these hidden damages that an insurer might overlook.

- Creating a Detailed Inventory: Recalling every lost item after a fire is nearly impossible. A public adjuster guides you in creating a comprehensive inventory of all damaged personal belongings, which is crucial for securing a fair payout for your contents.

- Estimating Full Repair Costs: A public adjuster brings in professional assessors to ensure all damages are accounted for. They build a documented claim with line-item repair estimates reflecting the true cost of rebuilding, not the insurer’s often lower initial assessment. This detail can significantly impact your final settlement.

The Realities of Fire Damage Restoration and Insurance Claims

While a fire public adjuster can be a valuable ally, it’s crucial to understand that even with their help, restoring a fire-damaged home and navigating the insurance claims process remains a complex, expensive, and often emotionally draining ordeal. We want you to be fully aware of the journey ahead, regardless of the path you choose.

Key Challenges in Restoration and Claims

Many policyholders are surprised by the ongoing difficulties even after hiring an expert.

- High Restoration Costs: As we mentioned, restoring a fire-damaged house can cost anywhere from $20,000 to over $500,000 for a total rebuild. These costs are often underestimated initially, leading to financial strain.

- Unpredictable Insurance Settlements: Even with a public adjuster, the final settlement is not guaranteed to cover all your costs or meet your expectations. The settlement is still bound by your policy’s terms, deductibles, and depreciation.

- Extensive Documentation Requirements: While a public adjuster handles much of this, the sheer volume of paperwork, photographs, and reports required is immense. This process can still feel overwhelming, and you’ll often be asked to provide further information. Many homeowners ask if you need fire adjusters precisely because of this documentation burden.

- Long Timelines for Repairs and Claim Resolution: Major fire losses can take several months, or even years, to settle and complete repairs. This extended timeline means prolonged displacement and uncertainty for your family.

- Emotional and Financial Stress: The aftermath of a fire is inherently stressful. Adding the complexities of insurance claims, managing contractors, and dealing with financial uncertainties can take a significant toll on your well-being.

Common Pitfalls and Hidden Costs

Beyond the public adjuster’s fee, there are other financial and emotional traps you might encounter.

- Contingency Fees for Adjusters: Public adjusters typically charge a percentage of the claim settlement, ranging from 10% to 15% of the total amount. This means that a portion of the money intended for your repairs and recovery goes directly to the adjuster. While they aim for a higher settlement, this fee directly reduces your net payout.

- Reduced Funds for Actual Repairs: After the adjuster’s fee, policy deductibles, and any depreciation applied by the insurer, the actual cash in your hand for repairs might be significantly less than the total settlement amount. This can leave you scrambling to cover gaps, especially if restoration costs run higher than anticipated.

- No Guarantee of a Higher Settlement: While public adjusters often secure higher settlements, there’s no absolute guarantee. Their success depends on the specifics of your policy, the extent of the damage, and the insurance company’s willingness to negotiate.

- The Process Can Still Be Very Long: Even with a public adjuster submitting a well-documented claim, the insurance company still has its own processes. We’ve seen that the time it takes for fire claim settlements can vary greatly, with complex cases sometimes stretching beyond six months. This prolonged period means continued stress and delayed recovery.

- The Ongoing Stress of Restoration: Even if your claim is settled fairly, you still face the daunting task of managing contractors, making countless decisions, and overseeing the actual rebuilding of your home. This process is far from simple. We dig into the financial implications in our guide: How Much Does It Cost to Fix Fire Damaged House?.

The Process: From Hiring to Potentially Firing a Public Adjuster

Engaging a fire public adjuster is a significant decision, involving contracts, state regulations, and the potential for the relationship to not meet your expectations. It’s another layer of complexity in an already challenging time.

How to Choose the Best Public Adjuster for Fire Damage

Selecting the right public adjuster is crucial. Here’s a step-by-step guide to help you make an informed decision:

- Verify State License: Always ensure the adjuster is licensed in your state or province. You can verify licenses through your state’s department of insurance, often found on the National Association of Insurance Commissioners (NAIC) website. For example, California requires adjusters to be licensed, bonded, and tested. In Canada, licensing is provincial, with bodies like Ontario’s FSRA overseeing adjusters. Never work with an unlicensed adjuster.

- Check References and Reviews: Ask for and contact current local references. Inquire if they would hire the adjuster again, if the fee was worth it, and how long the settlement took. Online reviews can also provide valuable insights.

- Read the Contract Carefully: This is non-negotiable. Understand every clause, especially regarding the fee structure and what it applies to. Be wary of adjusters who pressure you to sign a contract immediately after a disaster.

- Understand the Fee Structure: Public adjusters typically charge a percentage of the claim settlement, from 2% to 25% or more. Some states cap fees at 10% for one year after a declared state of emergency. Make sure the fee is clearly stated in writing.

- Assess Communication Style: A good public adjuster should be transparent, responsive, and able to explain their methods clearly. We recommend contacting several potential adjusters for initial consultations to gauge their communication style.

- Inquire About Experience: Ask about their adjusting experience and whether they are local. This ensures they are familiar with local building codes and construction costs.

For more detailed guidance on selecting your advocate, check out our resource on finding a professional fire adjuster.

State Regulations and Your Rights

As a policyholder, you have specific rights that protect you when dealing with public adjusters.

- Licensing Requirements: In the US and Canada, public adjusters must be licensed by their state or provincial regulatory body. This ensures they meet certain professional standards.

- Fee Caps in Disaster Zones: In many areas, especially after a governor declares a state of emergency, public adjuster fees are capped. For instance, in Florida, fees are limited to 10% of the claim payment for one year after the declaration.

- Contract Cancellation Periods (Cooling-Off Period): Most states and provinces provide a “cooling-off” period to cancel a contract without penalty. In New York, you can cancel until midnight of the third business day. In Illinois, you have 10 days. In Florida, you can cancel within ten business days, or 30 days after the date of loss if it’s related to a state of emergency.

- Your Right to Communicate with Your Insurer: You always retain the right to communicate directly with your insurance company, though the public adjuster’s role is to manage these communications.

- Solicitation Rules: Some states, like California, restrict when public adjusters can solicit business, such as not between 6 p.m. and 8 a.m. or for seven days after a disaster unless you contact them first.

Signs You Need to Fire Your Public Adjuster

While a public adjuster can be beneficial, sometimes the relationship doesn’t work out. It’s important to recognize when it might be time to part ways.

- Poor Communication: Consistent unresponsiveness is a major red flag. If you’re left in the dark about your claim’s status, your adjuster isn’t doing their job.

- Lack of Progress: If months pass without substantial developments and your adjuster can’t provide clear explanations, it might be time to reconsider.

- Unethical Behavior: This includes misrepresenting facts, pressuring you to inflate claim amounts, or any actions you’re uncomfortable with.

- Disagreements Over Claim Strategy: If you fundamentally disagree with your adjuster’s approach and attempts to resolve differences fail, the relationship may not be productive.

- The Termination Process: To terminate your contract, review it for specific clauses. Document all issues, try to resolve them directly, and then provide written notice of termination via certified mail. You’ll then need to secure your claim documentation and notify your insurer. We have a detailed guide on How to Dismiss a Public Adjuster: Your Rights and Process to help you steer this.

Frequently Asked Questions about Fire Public Adjusters

We often hear similar questions from homeowners struggling with fire damage. Let’s address some of the most common ones.

How much do public adjusters charge for fire claims?

Public adjusters typically charge a percentage of the total claim settlement. This fee commonly ranges from 10% to 15% of the total settlement amount. For example, if your claim settles for $100,000, and your adjuster charges 10%, you’ll pay them $10,000.

This fee is subtracted from your payout, meaning the money you receive for repairs and replacing contents is automatically reduced. In some states, particularly after a declared state of emergency, there are fee caps. For instance, in Florida, fees are limited to 10% of the claim payment for one year after the declaration, then 20% thereafter. This means you’re already starting with a smaller pot of money for your recovery.

Can I talk to my insurance company if I hire a public adjuster?

Yes, absolutely! You always have the right to communicate with your insurance company, even after hiring a fire public adjuster. The public adjuster’s role is to streamline and manage these communications on your behalf, acting as your single point of contact. However, you remain the policyholder, and the final decision on any settlement offer rests with you.

While your public adjuster will handle most of the back-and-forth, you might still receive direct communications from your insurer. It’s always a good practice to inform your public adjuster of any direct contact you have with the insurance company to ensure everyone is on the same page and your claim strategy remains consistent.

What if my fire claim is denied or delayed?

This is a common and incredibly frustrating scenario, and it’s often a key reason why policyholders consider hiring a fire public adjuster. If your claim has been denied or is significantly delayed, a public adjuster can step in to:

- Review the Denial: They will carefully examine the reasons for the denial, cross-referencing them with your policy language and the documented damages.

- Reopen Negotiations: If they find discrepancies or errors in the insurance company’s assessment, they can formally reopen negotiations.

- File an Appeal: They can prepare and file a robust appeal package, presenting new evidence, expert reports, and a strong argument for overturning the denial.

While a public adjuster can be instrumental in challenging a denial or pushing a delayed claim forward, it’s crucial to understand that this process extends an already stressful and time-consuming situation. Appealing a denied claim means more waiting, more paperwork, and continued uncertainty, delaying your ability to move on with your life. For a deeper dive into this, read our article on how to appeal a denied fire claim.

The Simpler Alternative: Skip the Claims Hassle and Restoration Nightmare

We’ve explored the role of a fire public adjuster, their benefits, and the significant challenges that persist even with their help. The insurance claim and rebuilding process is a long, uncertain, and expensive journey. You’ll face reduced payouts due to fees, endless negotiations, and the stress of managing a major construction project. But what if there was a simpler way?

Why Selling Your Fire-Damaged House Is a Better Option

At Fire Damage House Buyer, we believe you deserve a fresh start without the prolonged headache. We offer a direct, stress-free alternative to navigating the complex world of insurance claims and property restoration.

- Avoid the Insurance Battle: Instead of engaging in a lengthy, often adversarial process with your insurance company, you can bypass much of the negotiation. This means no more fighting over estimates, no more chasing down adjusters, and no more waiting for checks that may or may not cover your full costs.

- No Restoration Headaches: Forget about hiring contractors, overseeing repairs, or dealing with unexpected costs. Selling your house as-is means you don’t have to lift a finger for cleanup or restoration. This saves you immense time, money, and emotional energy. You can learn more about this approach in our article on the Pros and Cons of Selling a House As-Is.

- Get Quick Cash for a Fresh Start: Our company specializes in buying fire-damaged houses for cash. This provides you with immediate liquidity, allowing you to quickly secure new housing, replace belongings, and begin rebuilding your life without delay. For many, this offers a faster path to recovery than waiting months or years for an insurance settlement and repairs.

- Certainty vs. the Uncertainty of a Settlement: An insurance claim, even with a public adjuster, is often fraught with unknowns. Will the settlement be enough? How long will it take? When you sell your house to us, you get a firm cash offer and a clear closing timeline, providing much-needed certainty in an uncertain time. This certainty can be a huge relief, especially when considering What Happens If Your House Burns Down?.

How to Get a Fair Cash Offer and Move On

We understand that after a fire, you need solutions, not more problems. That’s why Fire Damage House Buyer simplifies the process into three easy steps:

- Contact Us: Reach out to us for a free, no-obligation assessment of your fire-damaged property. We buy houses in states across the US.

- Receive a Cash Offer: We’ll provide you with a fair cash offer for your house as-is, with no repairs needed. Our offers are transparent and reflect the true value of your property in its current condition.

- Close on Your Timeline: If you accept our offer, we can close quickly, often in as little as a week. You choose the closing date that works best for you, allowing you to move forward on your terms.

Instead of waiting months or years for an insurance settlement to cover repairs that will still leave you out of pocket, you can get a guaranteed cash offer for your property as-is. Contact us for a no-obligation offer, and close on your timeline. To learn more about getting a fair price for your property, visit Get a Fair Cash Offer for Your House and take the first step towards a fresh start. You can Sell Fire Damaged House today and leave the hassle behind.