Understanding the Aftermath: What to Expect When Disaster Strikes

What happens if your house burns down is a question no one wants to face, but knowing the answer can help you steer one of life’s most devastating events. A house fire triggers a cascade of complex financial, legal, and emotional challenges.

Immediate Priorities:

- Safety: Ensure everyone is safe and seek medical attention.

- Contacts: Call your insurance company, mortgage lender, and utility providers.

- Shelter: Find temporary housing, which your insurance policy likely covers.

- Finances: Your mortgage debt remains, and restoration can cost $3,000 to $50,000+.

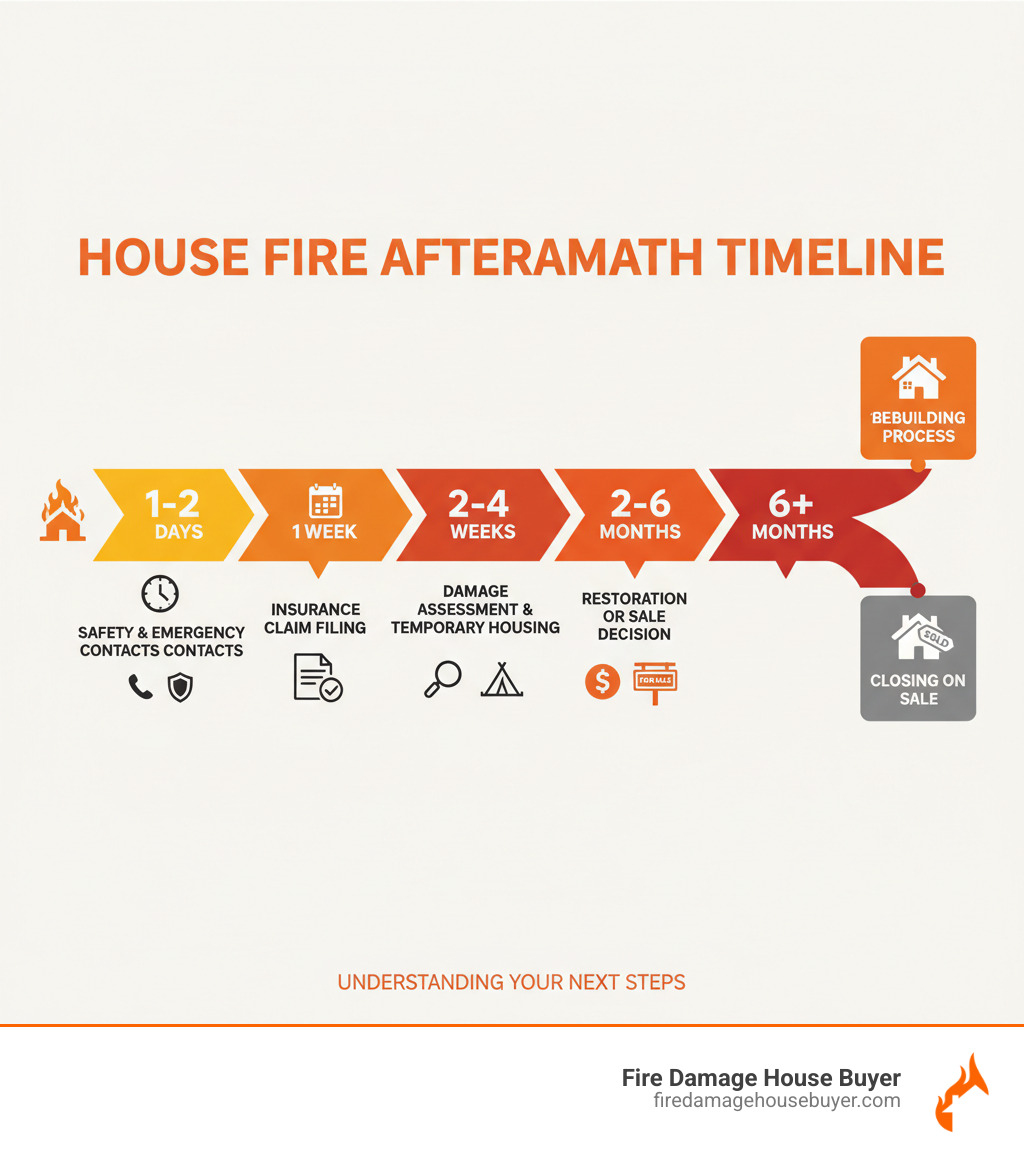

After the initial shock, you face two main paths: rebuilding, a months-long process of repairs and negotiations, or selling as-is for a fast cash offer to move on without the stress.

I’m Daniel Cabrera, and for 15 years, I’ve helped families understand what happens if your house burns down. My team has purchased over 275 fire-damaged properties, and I know that rebuilding isn’t always the best path for those who need to move forward quickly.

The First 24-48 Hours: A Step-by-Step Safety and Action Plan

When your home catches fire, your immediate priority is safety. Once the flames are out and everyone is safe, you’ll face a whirlwind of decisions. In 2022 alone, home fires caused $12.1 billion in property damage, affecting thousands of families. If this is your reality, know that there are clear steps to guide you.

Ensuring Your Family’s Well-being

Safety first, always. Call 9-1-1 and get everyone out immediately. Once safe, check for injuries like burns or smoke inhalation and seek medical attention. The emotional toll is also significant; shock, grief, and stress are normal reactions. Pay attention to your family’s emotional needs and lean on your support network. These tips apply to any house fire and can help you manage the emotional aftermath. Local relief organizations like the Red Cross can provide immediate assistance with shelter, food, and clothing.

Securing the Property and Finding Shelter

Do not re-enter your home until authorities declare it safe. Fire-damaged homes pose serious risks, including structural collapse, toxic fumes, and electrical hazards. Wait for official clearance from the fire department. For more details, refer to the steps you will need to take after a fire.

Your homeowner’s insurance policy is crucial for finding shelter. Most policies include “Loss of Use” or “Additional Living Expenses” (ALE) coverage, which pays for temporary housing and meals. Contact your insurer immediately to start the process. If you need help before your claim is processed, local relief organizations can provide emergency shelter.

Making Essential Contacts

Making the right calls quickly can prevent future complications. Here’s who to contact:

- Your insurance company: Report the fire immediately to start your claim. Document the damage with photos if you can do so safely.

- Your mortgage lender: You must inform your lender about the fire. Your mortgage payments are still due even if the house is destroyed. Insurance payouts are often coordinated with the lender. For more details, read our guide on What Happens to Your Mortgage If Your House Is Destroyed?

- Utility companies: Call your gas, electric, and water providers to shut off services and prevent hazards like explosions or electrocution.

- Your bank: If your wallet or cards were lost, cancel them immediately to prevent fraud.

- Fire department: Obtain a copy of the official fire report. This document is essential for your insurance claim.

Taking these steps will set you on the path to recovery, whether you decide to rebuild or Sell Fire Damaged House for a fresh start.

Navigating Insurance and Finances: What Happens If Your House Burns Down

The financial aftermath of a fire can feel as overwhelming as the flames. In 2022, home fires caused $12.1 billion in property damage, thrusting thousands of families into a maze of insurance claims and financial decisions. Understanding your policy is crucial for a stable recovery.

Filing Your Fire Damage Insurance Claim

Report the loss to your insurance company as soon as possible. Your agent will assign a claims adjuster and guide you through the process. Your most important job is to document everything. Take extensive photos and videos of all damage.

Create a detailed home inventory listing every item that was damaged or destroyed, along with its value. Gather any receipts, bank statements, or pre-fire photos you have to prove your losses. The more documentation you provide, the smoother your claim will be. Our Fire Damage Insurance Claims Guide offers more detail on this process.

Be cooperative with the insurance adjuster, but remember they work for the insurance company. If you disagree with their assessment, you can seek a second opinion. Claims can be denied for policy lapses, late reporting, or arson. If you believe a denial is unfair, you have the right to appeal.

Understanding Your Homeowner’s Policy Coverage

Most policies are designed to protect you, but knowing the specifics of what happens if your house burns down is key.

- Dwelling Coverage: This covers the physical structure of your home. The limit should reflect the cost to rebuild, not the market value.

- Personal Property Coverage: This protects your belongings. It’s usually a percentage of your dwelling coverage (50-70%).

- Loss of Use (ALE): This pays for temporary housing, meals, and other living expenses while your home is uninhabitable.

The distinction between Replacement Cost and Actual Cash Value for your personal property is critical:

| Feature | Replacement Cost | Actual Cash Value |

|---|---|---|

| Definition | Pays the amount to buy a brand-new item today, regardless of its age. | Pays the depreciated value of the old item; Replacement Cost – Depreciation. |

| Benefit | Allows you to replace lost items with new ones without out-of-pocket expenses. | You receive less than the cost of a new item, as wear and tear are factored in. |

| Typical Policy | Often an add-on or higher-tier policy. | Standard in many basic policies. |

Your mortgage adds another layer of complexity. Your mortgage doesn’t disappear, and insurance payouts are coordinated with your lender. For a detailed explanation, read our guide on What Happens to Your Mortgage If Your House Is Destroyed?.

What happens if your house burns down and you have no insurance?

Facing a fire without insurance is a financial catastrophe. You are solely responsible for all costs: rebuilding, replacing belongings, and temporary housing. Crucially, your mortgage obligations do not disappear. You could be making payments on an unlivable property while trying to afford shelter elsewhere, potentially leading to foreclosure and bankruptcy.

The cost to rebuild can range from $3,000 for minor damage to well over $50,000 for extensive repairs, often exceeding $100,000 for a full rebuild. While government aid (like FEMA) and community support (Red Cross, fundraisers) can provide immediate relief, they rarely cover the full cost of rebuilding.

For many uninsured homeowners, the situation feels impossible. An alternative path is selling the property as-is. This allows you to receive cash, satisfy your mortgage, and move forward without the crushing burden of rebuilding. For many, the decision to Sell Fire Damaged House becomes a lifeline to a fresh start.

The Restoration Process: A Guide to Cleaning and Repairing Fire Damage

Rebuilding after a fire is a long, complex journey. From cleaning toxic soot to major structural repairs, the process requires significant time, money, and effort. The aftermath is not just messy; it’s hazardous.

Assessing the Damage and Salvaging Belongings

After the fire department clears the scene, a professional damage assessment is crucial. A trained expert will evaluate the full scope of damage, which often includes:

- Structural Damage: Compromised walls, roofs, and foundations that can make the home unsafe.

- Smoke and Soot Damage: Corrosive soot and a pervasive odor that penetrates every surface, making a home unlivable.

- Water Damage: Moisture from firefighting efforts that can lead to hazardous mold growth if not addressed quickly.

- Heat and Burn Damage: Warped materials and charred wood. The extreme temperatures involved can be immense, as detailed in our article on How Hot Does a House Fire Get?.

While some belongings may be salvageable, many sentimental items are often lost forever. When attempting to recover items, always wait for official clearance and wear protective gear. Discard any food exposed to heat, smoke, or soot, as it can be contaminated.

Cleaning Up After a House Fire: Safety and Best Practices

Cleaning up after a fire is dangerous. Debris can contain toxic chemicals, asbestos, and sharp objects. For this reason, professional restoration is strongly recommended over a DIY approach. Professionals have the specialized equipment and expertise to safely handle hazards, remove smoke odor from HVAC systems, and prevent mold growth. For more information, see our guides on Cleaning Up After a House Fire and our complete house fire damage restoration guide.

Restoration costs are substantial, ranging from $3,000 to $7,000 for minor smoke cleanup to $50,000 or more for major structural work. These costs can easily exceed insurance payouts. Many homeowners find the months-long process too draining, which is why selling your fire-damaged home as-is to Sell Fire Damaged House is often a simpler, faster path forward.

The Crossroads: Deciding Between Rebuilding and Selling Your Damaged Home

After a fire, you face a major decision at the heart of what happens if your house burns down: endure the long, expensive process of rebuilding, or choose a simpler, faster path. Understanding both options is key to making the best choice for your family.

The Reality of Rebuilding

Rebuilding a fire-damaged home is a monumental task. Costs can range from $3,000 to $50,000+ and often escalate due to:

- Unexpected Costs: Hidden structural damage, asbestos removal, and mandatory code upgrades can inflate your budget.

- Long Timelines: The process of assessments, permits, and construction can stretch for months or even years.

- Constant Management: You’ll spend countless hours managing contractors and navigating building codes.

- Insurance Gaps: If your insurance payout doesn’t cover the full cost, the difference comes out of your pocket.

The emotional and physical exhaustion of this process is real and often underestimated. Many families find themselves asking if the journey is worth the strain.

The Simpler Alternative: Selling Your House As-Is

For many, selling a house as-is to a cash buyer is a simpler alternative that provides immediate relief. This path allows you to:

- Avoid All Repairs & Cleanup: We buy your property in its current, damaged condition.

- Skip Contractor Negotiations: You won’t have to manage bids, timelines, or construction work.

- Pay No Commissions or Fees: Unlike a traditional sale, you keep the full cash offer.

- Get a Guaranteed Fast Sale: We can close in weeks, not months or years.

This process puts you back in control, allowing you to focus on healing rather than managing a stressful restoration project. Our guide on How to Sell a Fire-Damaged House explains how simple the process can be.

Ready to move on? Sell Fire Damaged House for a fair cash offer and a fresh start.

Frequently Asked Questions About House Fires

After a fire, you’re left with urgent questions. Here are concise answers to the most common concerns homeowners face when dealing with what happens if your house burns down.

What happens to your mortgage if your house is destroyed?

Your obligation to pay the mortgage remains. The loan is a contract that doesn’t disappear with the house. As a condition of your mortgage, you likely have homeowners insurance. Your insurance payout will be coordinated with your lender to either pay off the loan or fund the rebuilding process. You must continue making monthly payments to avoid foreclosure. For a deeper look, read our guide on What Happens to Your Mortgage If Your House Is Destroyed?.

How can you prove your losses to the insurance company?

Thorough documentation is key. To prove your losses, you need to:

- Create a detailed home inventory list of all damaged or destroyed items with their estimated values.

- Provide supporting evidence like photos, videos, receipts, and bank statements.

- Obtain a copy of the official fire report from your local fire department, as insurers almost always require it.

The more evidence you provide, the stronger your claim will be.

What are the biggest dangers of re-entering a fire-damaged home?

Re-entering a fire-damaged home is life-threatening. Never go back inside until fire officials give you official clearance. The primary dangers include:

- Structural collapse: Weakened floors, walls, and roofs can give way without warning.

- Respiratory hazards: Toxic soot, ash, and chemicals can cause severe lung damage.

- Electrocution and injury: Damaged wiring, sharp debris, and hidden hot spots pose serious risks.

When cleared for entry, wear protective gear. Our article on Cleaning Up After a House Fire provides more safety protocols. Dealing with these dangers is one reason many choose to Sell Fire Damaged House as-is, avoiding the risk and stress entirely.

Conclusion: Your Path Forward After a Fire

Recovering from a house fire is a marathon. What happens if your house burns down involves months or years of navigating insurance claims, managing contractors, and carrying the emotional weight of rebuilding. The traditional path of restoration is long, expensive, and exhausting.

But you have another option. By selling your property as-is, you bypass the entire ordeal. No hazardous cleanup, no complex insurance negotiations, no contractor headaches, and no uncertainty about costs. You simply walk away from the stress and move forward with your life.

Fire Damage House Buyer offers a fair cash offer for your home, allowing you to move on quickly. We buy fire-damaged houses in any condition across the country, including states like Alabama, California, Florida, Texas, and many others. Our process is simple: we make an offer, and if you accept, we close fast. No commissions, fees, or repairs are needed.

If you’re ready for a fresh start, Contact Us today for a no-obligation cash offer. Sometimes the best way to rebuild your life is to start fresh somewhere new. Sell Fire Damaged House and take the first step toward closure and peace of mind.